Dear All Steels Customers,

Two months have passed since our last posted newsletter and as always, the main purpose of such messages is to communicate All Steels’ views on the market / events and more importantly anticipated developments ahead.

In our messages over the last 5-6 months, we have been able to predict steel price increases primarily by showing the rising cost of raw materials associated with steelmaking that have all necessitated mills moving their prices up to maintain profitability. The graphical displays with some basic explanations have been easy to understand and the steel price increases have clearly been justified. Again, in the graphs below such base costs remain high and mainly on an upward trajectory, especially iron ore that has moved to a 10-year high. However, we are now entering a new paradigm of market pressures that are even more price influential. This being basic economics, where demand exceeds supply, and this is occurring at a time when stocks within the supply chain are already coming from a very low base following the effects of the Covid-19 pandemic.

It is also clear that we have a huge gulf with respect to price and availability between long products and flat products where the latter has already entered a stage of critical shortages with a consequential surge in prices. As All Steels our expertise is on long products, so our message needs to bear this in mind although as a seller of hollow sections that is a derivative of HR Coil, we do make some references to the flat rolled market in this context.

The usual graphs are detailed below and now require little explanation based on past newsletters, so we have skipped over the usual narratives as going immediately forward it is far more important to focus on supply / demand.

STEELMAKING COST DRIVERS

1: Iron Ore

1.7t of iron is required to make a tonne of steel.

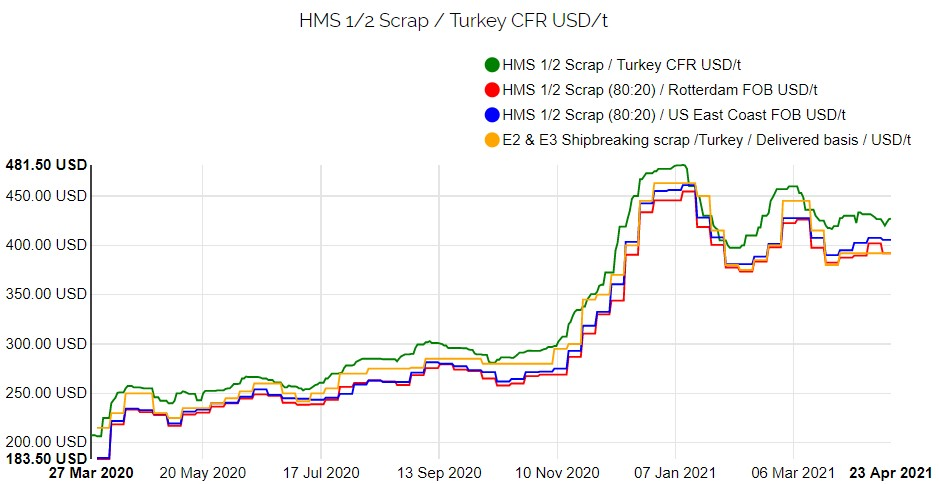

2: Scrap

1.1t of scrap is required to make

a tonne of steel.

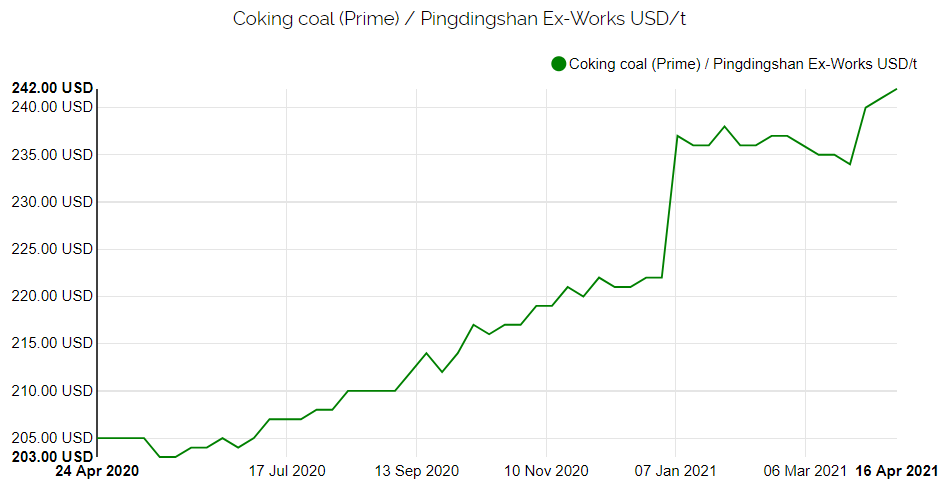

3: Coking Coal

0.7t of coking coal is required to make a tonne of steel.

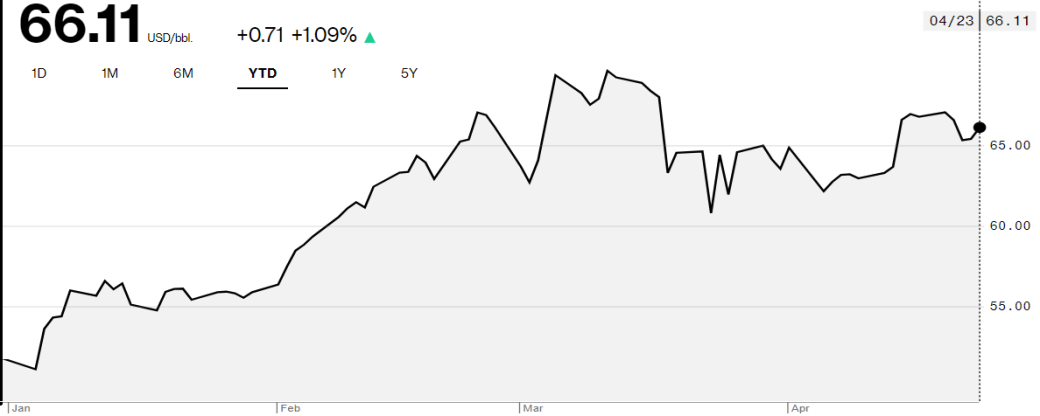

4: Oil Prices

Main influencer of energy and transportation costs.

Supply and Demand

At present we have several factors which have created a steel supply and demand imbalance both at a macro and micro level and in no particular order we have simply listed what we consider to be the main factors:

1. According to the Worldsteel Association despite the Covid-19 pandemic 2020 global demand for steel only fell by 0.2% y-o-y, to 1.7 billion tonnes. (This was due to a surprisingly robust recovery in China). This year Worldsteel is forecasting that demand will recover by 5.8% y-o-y and in 2022 by 2.7% y-o-y. We are therefore going to see all-time record-breaking consumption over the years ahead.

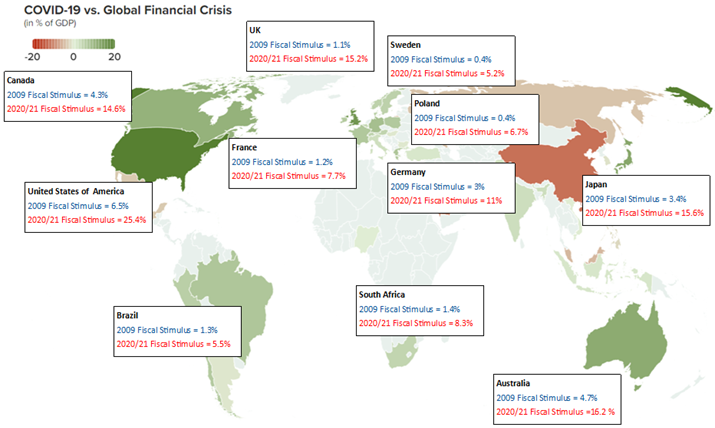

2. On the world stage most of the main countries plan to inject huge financial stimulus packages and lot of this funding will be aimed at infrastructure projects to effectively build countries out of recession. To understand the scale of fiscal stimulus around the world the Atlantic Council Organisation publish some very detailed information on their website and the image below best illustrates the level of stimulus packages by drawing comparisons between planned support to recover from the Covid-19 pandemic compared to the levels of support made back in 2009 to assist recovery from the financial crisis.

3. Closer to home data produced by the National Association of Steel Service Centres shows that March 2021 sales had fully recovered to March 2020 levels but by contrast service centre stock levels are hovering around a level of 70 days of sales compared to a more normal 100 days of sales. Very few stockists have been able to build up stocks. Moreover, there is now a question of affordability and desire to build back to normal stock levels given the high costs even if availability exists.

4. In our local market the difficulties for Liberty Steels are well publicised and until such time that group finds a financial resolution output from their many steel manufacturing facilities in the UK will remain badly restricted.

5. China is entering its traditional period of enforcing steel production restrictions to curb dangerous levels of air pollution. At the end of last week Handan Municipal Government, announced such restriction measures for April 21 to June 30 of this year. The estimated resulting average daily production losses in Handan for wire rod, steel plate and HR Coil will amount to 8,700mt, 6,500mt and 5,600mt respectively!

6. Closer to home All Steels has tried to keep its review of supply and demand simple by looking at EU production capacity and EU apparent demand whilst recognising that import balancing is more difficult with Safeguard measures in place.

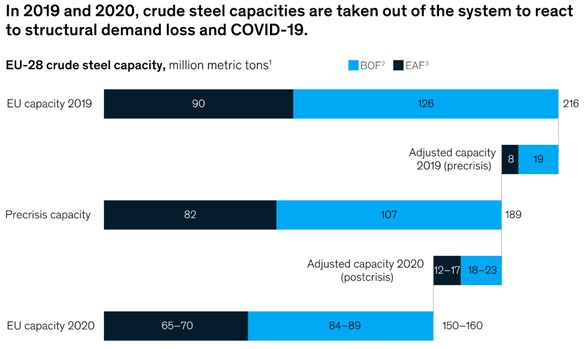

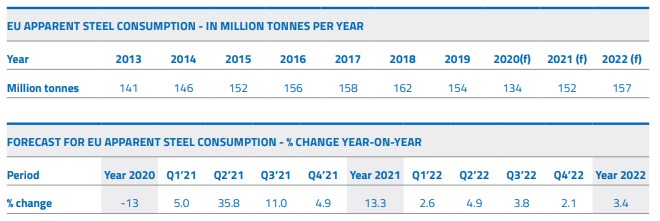

Data 1 (below) is data published by McKinsey, which shows that massive EU crude steel capacity in 2019 of 216mt was reduced to 150-160mt by the end of 2020.

Data 2 (below) is data published by Eurofer, which shows that apparent demand forecast for 2021/2022 should climb to 157mt.

Evidently, we can see that apparent demand in the EU is forecast to have fallen by 13% in 2020 and to rebound to +13% in 2021 and whilst quick transition in apparent demand can occur steel producers (especially those that have closed plants and turned off blast furnace capacity) just cannot react so quickly. It therefore seems inevitable that in the short term the EU will need more imports at a time when world demand is increasing. In addition to the resulting tight availability Safeguard quotas will therefore start to be exceeded on many products resulting in large duty payments that we as a UK trader are already starting to experience. In the short to midterm, it therefore seems inevitable that the cost of steel will continue to rise until such time that EU producers can bring on stream additional capacity. All Steels’ view is that EU producers will most likely avoid such expenditure having now seen the price benefits of keeping supply tight. They will therefore in the short to midterm typically prefer to take profits rather than take risks and go to the huge expense of bringing lost capacity back to life.

Data 1

Data 2

Looking more specifically at the UK here is our view on each of the products we trade.

UK PRODUCT REVIEWS

Merchant Bar

Price increases by the mills are becoming less formal by way of public announcements but they are all increasing prices and a lot of the adjustments have become more sophisticated and product focused where bigger extras are logically being applied to those products that cost more to produce or are on tighter availability.

It is the supply situation however that has become more alarming. The well-publicised financial problems in Liberty Group are seriously constraining output at one of the UK’s largest producers (Liberty Merchant Bar). We are also finding that some of the producers of the smaller sizes of merchant bar have ceased production (Cogeme, Italy & Feralpi Profilati Nave, Italy) and large producers such as Beltrame appear to be shying away from the very small merchant bar sizes and those product sizes where demand is traditionally small. To cap off the supply difficulties containerised goods out of Turkey have almost become impossible due to lack of containers especially after the infamous Suez Canal blockage and this will probably take several months to rebalance container availability (the container box situation was already dire all the way through Q1 before the Suez Canal event). As most merchant bar is containerised out of Turkey such supply has basically dried up!

What is apparent just now is that many UK distributors of merchant bar have turned to mainland EU supply to address the imbalance and whilst this should improve availability from UK stockists it seems a foregone conclusion that UK Safeguard quotas will be breached at some point in Q2 on EU imports, and this will either block supply to the UK as imports are deferred until Q3 or it will simply result in price premiums as the distributors will need to recover the 25% duty hits.

As a final point it is evident that merchant bar is probably the poor relation with respect to market prices on popular sizes. Hence, whilst this is the case it is most exposed to the rising costs of steelmaking and any upshift in scrap prices, which seems highly likely in the EU, will automatically have to trigger further mill price increases.

Structural Sections

Since our last newsletter British Steel announced a further £30 per tonne increase on 5 March 2021 taking total increases since the summer of last year to £260 per tonne. It was expected that price increases would keep flowing through to properly restore profitability for the large EU manufacturers but evidently this has not happened. The environment for further prices increases in the UK seemed very likely with the inflow of EU imports remaining very low and virtually no supplies arriving from further afield.

All Steels’ view is that underlying demand did not accelerate as quickly as anticipated and so some of the heat out of the necessity to increase prices diminished as scrap prices stabilised /slightly softened. At this present time NASS data does show that stocks within the distribution chain remain very low and it feels like we are at that turning point when underlying demand is about to jump up with so many new infrastructure projects being awarded. As shown early on in this report iron ore prices have also continued to push up over the past few weeks and pressure must therefore be returning to our domestic BOS route steel producer (British Steel) to increase prices.

What is also worthy of note is that British Steel does produce slabs on its concast lines at Scunthorpe and with slab market prices rising close to section prices this does present a very good profitmaking opportunity for British Steel if it wishes to sacrifice some heavy section production for more lucrative slab sales. Logic would suggest that British Steel would not wish to cut section production, but it does form a basis for them to choose to be more price aggressive on section selling.

Given all the above we are therefore of the view that we might be on the cusp of further section price increases that should become clear quite early as we progress through Q2.

Hollow Sections

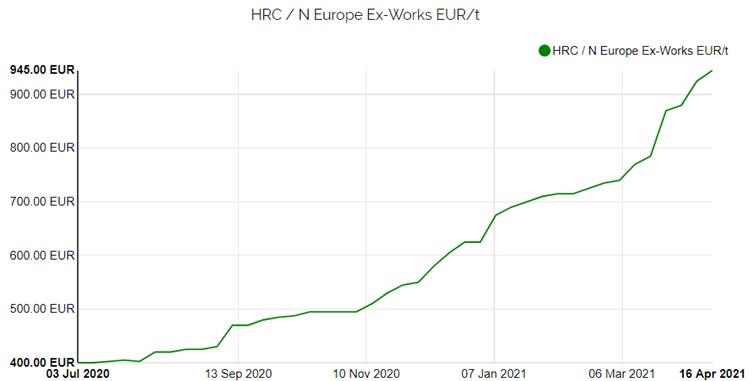

As a direct derivative of HRC hollow sections are in critically short supply and it appears that the situation will only get worse. As a large trader of this product, it simply feels like the quota level for Turkish, UAE and even EU supplies is inadequate since the new UK Safeguard quotas came into play on 1 January 2021. Only last week we received retrospective C18, HMRC duty invoices for our proportion of quota exceeded on day 1 of Q1, and in the coming months, we will see repeat retrospective HMRC bills for day 1 of Q2. (These are very hefty charges!). Import duties are therefore going to become a standard feature of importing hollow sections and as general hollow sections prices rise this becomes an even bigger number! We then have the headline price issue that is being driven by massive HRC availability constraints and the consequential price surge.

On Friday, the EU’s largest steel producer (ArcelorMittal) announced another €30p/t of increases to take HRC to €1,000p/t. (€200p/t of increases since 4 March 2021). The graph below best illustrates the HRC movement although it does not yet reflect the most current increase:

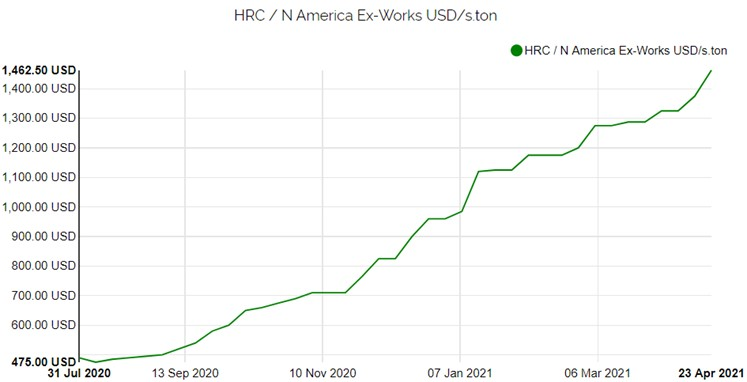

Whilst this surge in EU HR Coil prices looks excessive you only need to look at the US to see what effect further shortages can have on steel prices where mill selling prices have tripled over the last 9 months.

It is therefore fair to conclude that hollow sections will

remain the most troublesome product. Tight availability will become a

bigger issue and it is difficult to predict how high the price will go but it

is clearly going to be substantial.

From an All Steels point of view we have already signed off

contracts for Q4 supply, but we have only booked two vessel loads rather than

the three vessel loads we booked for Q3. This decision was basically

governed by affordability with respect to banking facilities available due to

the high prices but virtually all this capacity has been forward sold. We

have also seen a rush on sales of our hollow section stocks even though we have

substantially increased prices. It is therefore already a foregone

conclusion that we will have little stock /forward availability for the rest of

this year. We are sure that other steel traders will be facing the same

issues and it may be that we will see a reversal of structural sections

displacing what has become traditional markets for hollow sections as we

genuinely believe that the shortages will be catastrophic!

Conclusion

As a summary note, we are of the view that:

1. World steel demand is

likely to skyrocket as we move into a safer world post the height of the

Covid-19 pandemic as a successful vaccine protection rollout continues.

2. Steel producers will

have to increase production and possibly re-open closed facilities to meet

new levels of higher demand, but their approach will be cautious keeping

supply tight for some time.

3. Stocks amongst the

stockholding community are unlikely to fully recover as the high prices

make it unaffordable for many and the risks will be too high when supply

catches up with demand, even though the shortages are envisaged to persist

for some time.

4. Base materials that

influence steel prices will remain strong off the back of forecasts that

global crude steel production will grow to an all-time world record high

over the next two-year period.

5. Other costs associated

with steel manufacturing and distribution are all increasing, and look set

to continue with further rises ahead i.e. raw materials, energy, all taxes

including environmental, road transport, shipping, trade insurance,

employment, mill housing/warehousing, port handling charges, etc.

The underlying message here is that the scene seems to be

set for steel prices to remain high and with tight availability!

Please note that these are only All Steels’ views and

experiences, which we have generally been asked to share. However, we

hope this provides you with some useful guidance on how pricing in our

professional opinion is most likely to continue to unfold.