13 August 2022 Update Report

It was the outbreak of war in Ukraine commencing at the end

of February 2022 which catalysed huge steel price inflation. (Ukraine’s

immediate closure of its huge steel plants combined with swift, tough steel

sanctions being applied on Russia by many of the world’s leading countries

naturally created immediate steel shortages).

However, there were many countries that left the doors open

to Russian steel supplies, and in Russia’s desperation to keep steel export

volumes progressing they crashed prices to irresistibly low levels to attract

buyers. Turkey was a typical example that seized the opportunity to buy

cheap Russian semis / hot roll coil and after 3 months such re-rolled product

that effectively became Turkish origin supply crashed into the EU at low

prices. The turnaround in this Russian base raw material to hit the EU

was surprisingly quick and EU Governments have so far failed to fathom out how

to block such supplies although the natural EU and UK Safeguards are starting

to prevent a huge deluge of such supplies. With so many of the Turkish

manufacturers turning off their own steel manufacturing in favour of Russian

semis / hot rolled coil, the world’s largest scrap buyer (Turkey) massively

switched down its purchases of scrap and this action virtually halved the price

of scrap at the start of the summer months.

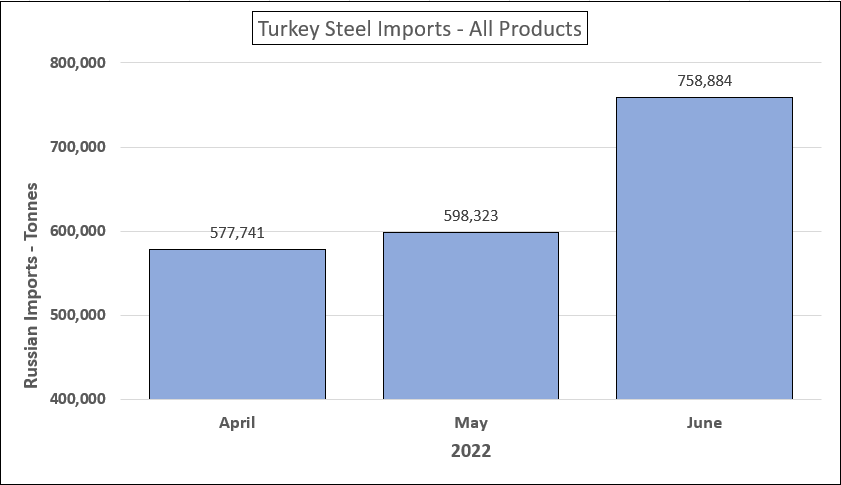

The charts below clearly illustrate Turkey’s level of

support for Russian purchases and the consequential downturn in scrap

prices. (Turkey is used here as an example but the same transition took

place in many other countries i.e., Egypt, India, UAE, Vietnam, China, etc).

| Product |

Jan-Jun 2022 (tonnes) |

| Billet |

732,147 |

| Slab |

1,057,232 |

| Hot Rolled Coil |

437,814 |

| Scrap |

407,588 |

All products 3,837,265 tonnes

For interest during the whole of 2021 Turkey imported

860,905 tonnes of slab from Russia so imports of this product are running at a

circa 250% increase here.

The volume of Russian imports of all steel products

accelerated dramatically in June which coincides with when we saw the downward

price pressure start to materialise in the UK.

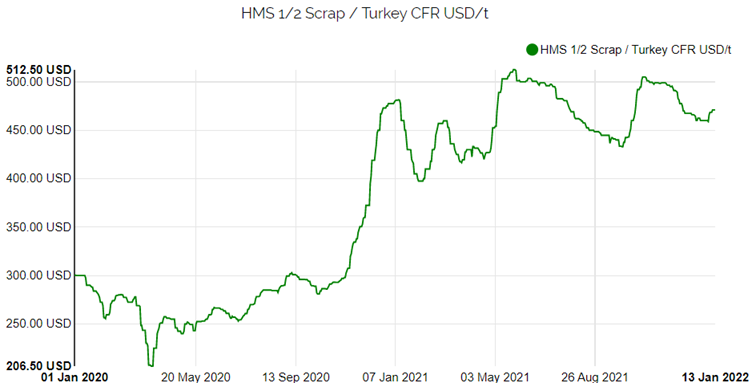

As many Turkish producers switched to using Russian semis,

rather than making their own steel, scrap prices tumbled basically reflecting

the reduction in purchases. (Evidenced in the chart below).

The Changing Market

Over the course of the current month many of the dynamics

that influence steel prices have changed particularly for the UK. Hence,

All Steels’ view is that steel prices will push up during September and

availability issues may once again return on certain long products for the

numerous reasons expressed below:

Scrap

As Russian base raw material faces more scrutiny in the EU,

Turkish producers appear to be making a switch back to more domestic crude

steel production and increased buying activity has lifted the price by circa

$50 per tonne over the last 7 days. This change is also starting to push

up EU prices so higher raw material costs will become apparent for all EAF

steel producers.

Energy

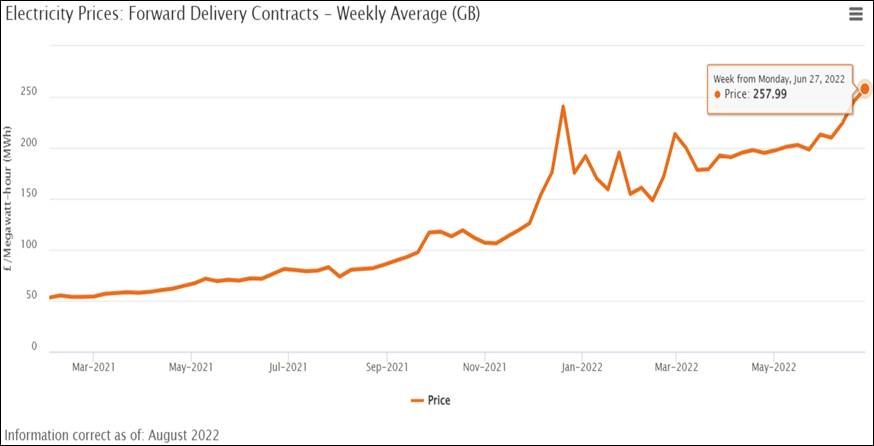

The rising cost of energy has been topical for some time,

but the tightening of Russian gas supply is intensifying, and this is now

occurring at a period of running into the autumn / winter months when

consumption increases.

Last week the UK natural gas futures broke above the 400

GHp/Thm mark underpinned by prospects of further supply disruption at a time of

entering an increase in demand.

Constant heatwaves and consequential record droughts across

Europe currently threaten to stop energy shipments along the River Rhine in

Germany exacerbating concerns in what is already a tight market. Russia’s

Gazprom continues to cite issues with turbines in the Nord Stream main pipeline

constraining supplies to just 20% of normal capacity.

At present the gas pipe channels linking the UK to the EU

have been working to full capacity. The UK has also been using its

existing excess regasification capacity to improve more LNG and reselling this

as natural gas to the EU.

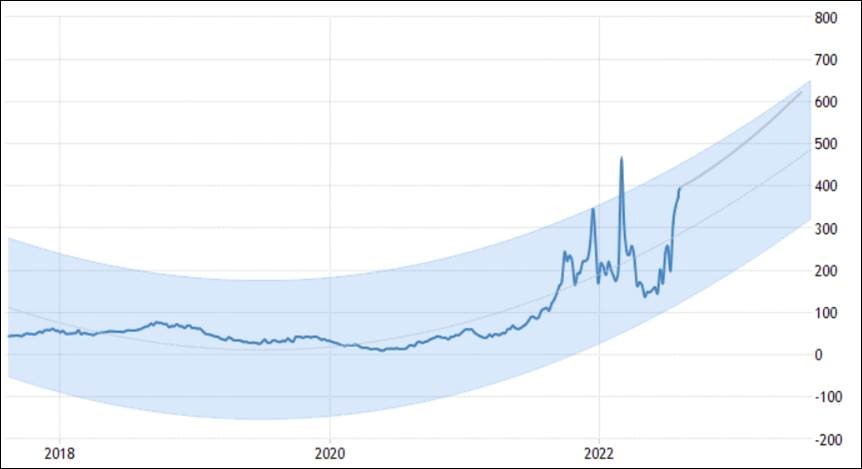

As winter approaches higher gas prices are a certainty with

little prospect of peace for the Russia/Ukraine conflict. According to

Trading Economics’ global macro models their analysts expect that UK Natural

Gas will trade at 424.41 GHp/Thm by the end of this quarter and rise to 622.02

GHp/Thm in 12 months’ time!

Trading Economics Graphical Forecast – UK Natural Gas

Unsurprisingly electricity prices are following the same

upward trend, and this is evident from current data provided by Ofgem UK Government

data as graphically shown below.

UK Safeguards

On structural sections new quota rules came into effect from

the 1st July which removed some developing nations’ exclusion

rights. Under Quota 058029 the tonnage set for the period 1st July 2022 to 30th September 2022 was 16,716 tonnes. With

Turkey, India and some other ROW suppliers now grouped together the quota on

this product category turned critical at the start of August and it is already

believed that tonnage bonded in UK ports awaiting clearance on the 1st October will likely result in the Q4 quota being exhausted on the first day of

the new period.

A similar picture exists on merchant bar where excessive

supply exhausted the Q3 quota very early and again bonded quantities will

likely exhaust the Q4 quota on the very first day of the period.

Duties on the likes of Turkish and Indian origin products

will have high risk exposure to attracting duties.

Port Congestion

The issues associated with port space remain a problem and

with more material having to be bonded for lengthy periods to avoid duties the

problems will arguably only intensify.

The other big news this week is that 1,900 dock workers will walk out on strike at the UK’s biggest

container port (Felixstowe) between the 21st to the 28th August 2022. This will result in circa 45,000 containers not being

processed and will create backlogs running into the year end with huge

demurrage penalties likely to be experienced by importers. With the dockers having already rejected pay

settlements above 7% this dispute could be a long-drawn-out affair with even more disruption to follow. With Felixstowe

handing circa 40% of all UK container movements the disruption here will be

massive. Whilst such constraints appear in all ports the costs are

continually rising and warehousing costs in many ports have increased 8-fold

over the past 12 months.

Liberty UK

The outage at many of the Liberty UK steel plants remains

an issue and Liberty Merchant Bar PLC has now been out of production for nearly

6 months with no immediate signs of a restart. Surprisingly, the absence

of such a major supplier of merchant bar to the UK market has not really been

missed but with excessive Turkish merchant bar imports now likely to trigger

duties going forward the product will undoubtedly see an uplift in market

prices.

Currency

The devaluation of the £

sterling against the US$ has been significant during Q2/early Q3 due to high

recessionary concerns in the UK. This has been noticeable on All Steels’

new US$ based steel purchases adding circa 12% to our sterling purchase costs

on Q4 supplies.

With the media widely reporting economic gloom for the UK

and with fiscal intent in the US to keep pushing up interest base rates above

those applied in the UK the £ is likely to remain weak for some time.

Conclusion

We have not included details on all the steelmaking

commodities in this report but coking coal spot prices as an example have

increased from $188 to $238.50 per tonne over the last fortnight according to

Simpson Spence Young. General inflationary measures and the

ever-increasing costs of finance can also not be ignored by steel producers.

Hence, All Steels’ considered belief is that all the

fundamentals will put significant pressure on the mills to increase prices

shortly. Moreover, these pressures are occurring at a time when stocks in

the supply chain are believed to be moving to very low levels as we approach

September so mills will certainly react very quickly on price in added response

to increased steel buying activity!