Dear All Steels Customers

It is only at unprecedented times that we feel the need to

go to print on events that are having a major impact on steel prices and we have

again reached such a point in time.

As always for simplicity we will keep to straight forward

facts that are mainly in the public domain and leave you to make your own

judgement. From an All Steels perspective however we just feel it is

necessary to convey such news so that all our customers are forewarned as to

why our prices are rising with the added problem of stock outages on a number

of our key products that will be difficult to replace until early July 2019.

The issues are basically four fold: Iron Ore, Coking Coal,

Scrap & Safeguards. There is also the BREXIT factor to come into play

but this is such an unknown we are wisely keeping away from this debate.

Iron Ore

The catalyst for change on steel prices started with the

disaster that took place in Brazil on the 25 January 2019 with the collapse of

a major dam at Vale’s Córrego do Feijão mine. This was the second

Brazilian dam to collapse in 3 years linked to iron ore production. The

death toll on this occasion is likely to exceed 300 people and the severity of

the humanitarian and environmental disaster has prompted huge government

intervention.

As of this morning Vale declared force majeure on some iron

ore contracts after a court-ordered halt to a mine responsible for nearly 9 per

cent of Vale’s output. The force majeure came after a court on Monday

ordered it to stop using eight tailings dams, including one affecting

production of about 30 million tonnes of iron ore output per annum.

Numerous dams in Brazil are now coming under heavy scrutiny

and further mining operations could be suspended.

Iron ore prices have surged since the disaster, hitting

effectively a two-year high.

The graph below shows the rate of price change. There

are various published iron ore price indices / recordings but they all show the

same trend movement. The graph below is for: XSIO001 – SGX 62% Fe Iron

Ore Cash-Settled Swaps (dry metric tonne) – CFR Tiamjin Port, China import $/t.

What the graph below shows is over a 30% increase in iron

ore prices since the December year end. This equates to a $25 per tonne

movement but with 1.7t of iron ore required to make a tonne of steel this

amounts to a $42.50 per tonne impact on steel prices.

What is also known is that Europe is one of the large export

markets for Brazilian iron ore and with many of the European buyers being

forced to find new supplies quickly following Vale’s force majeure such action

logically suggests further upward price pressure will follow.

Coking Coal

The news of Monsoon weather conditions in Queensland

Australia is making world news headlines with the city of Townsville being

completely flooded as officials were forced to release floodgates at an

overwhelmed dam. Loss of human life was again experienced and at least

20,000 homes have been flooded.

The city’s streets are reportedly full of washed in

crocodiles and snakes and whilst this remains the main focus of the news feeds

the monsoon has now moved south into the Bowen Basin and heading towards McKay

where all the major Australian thermal coal mines and coal port terminals are

located.

There is plenty of web news live on this topic as the heavy

rains continue e.g.

https://think.ing.com/snaps/the-commodities-feed-heavy-crude-osp-raised/

A paragraph in this link reads as follows:

Coking coal disruptions: “Floods in Queensland, Australia have led to some

disruptions at coal mines and export terminals in the region. Queensland’s main

coal exporting terminal, Abbott Point has suspended operations, whilst Glencore

has also halted operations at its Collinsville and Newlands mines. This

comes at a time when there is plenty of uncertainty over iron ore supply,

following the recent Vale dam accident. Yesterday, Vale declared force majeure

on some contracts, following a court order to suspend 30mtpa of capacity.”

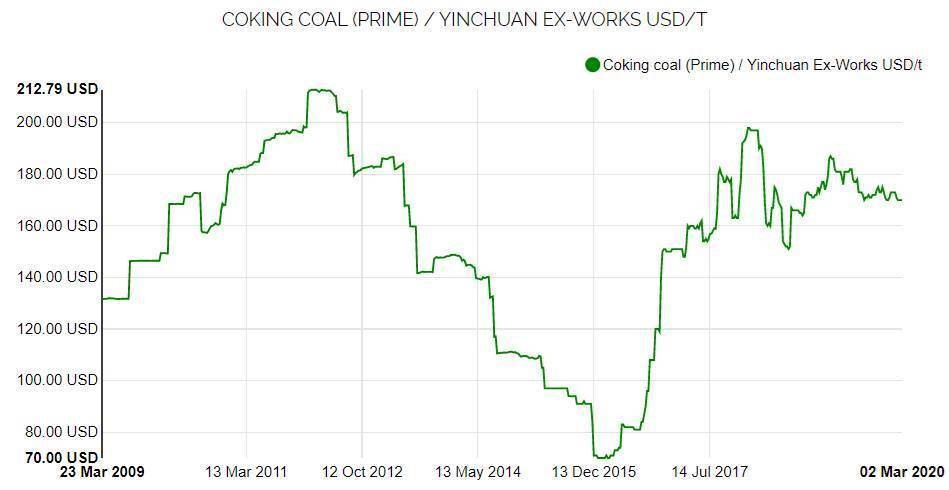

The events of the Australian

mines being hit by the monsoon is breaking news so the impact on coking coal

prices will not be known until early next week but the below reports generated

by Simpson Spencer Young show a $15 per tonne rise in coking coal prices over

the last 2 week period against a background of forecasters predicting a decline

in coking coal prices. (It is estimated that 0.7t of coking coal is

required to produce a tonne of steel).

Scrap

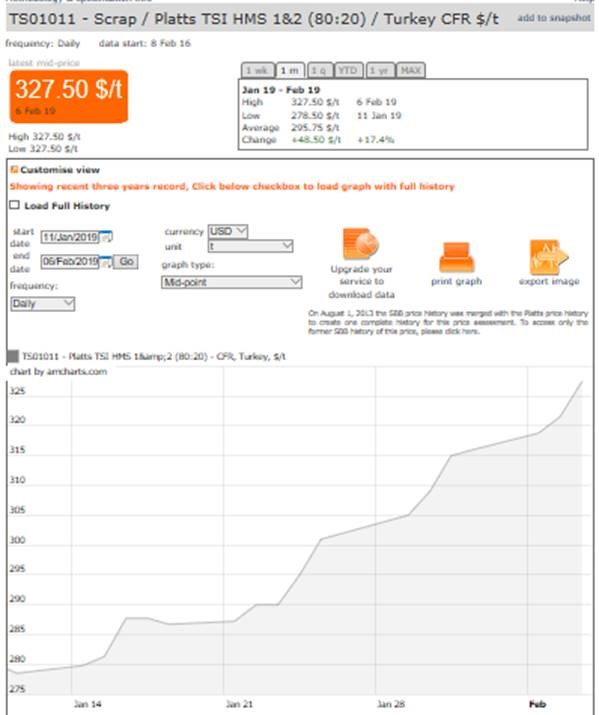

When any events in the world have a potential impact on steel

prices Turkish scrap prices always respond the quickest and most

aggressively. As a single price indicator the Turkish scrap price is

therefore an excellent barometer to watch.

Given the Iron ore and coking coal situation it is therefore

not surprising to yet again see a huge shift in Turkish scrap prices.

There is little narrative that is required to explain the

below. An upward shift in price of $49 per tonne in less than a month

with 1.1t of scrap required to make a tonne of steel.

This evening one of our major Turkish steel suppliers

refused to commit to an offer as scrap prices today moved up by the hour as

they were trying to buy and they are expecting more of the same in the lead up

to the weekend.

Safeguards

The impact of EU Safeguards only started to materialise in

the closing weeks of December as quota levels by product quickly started to

fill up. As All Steels Trading we had first-hand experience with a

December shipload of hollow sections that we quite simply had to bond to avoid

the risk of a 25% duty charge. On 2 February 2019 we entered a

new 5 month duty window and like many other traders we were busy customs

clearing our bonded cargos but the situation is very confusing and extremely

high risk going forward over the next 2 quarters.

We are sure most of you will be up to speed on EU Safeguards

but the below should help to clarify how the current situation is going to

result in All Steels Trading having stock outages during the first half of the

year.

For the purpose of explaining our issues we will focus

specifically on hollow sections even though we believe some other products have

bigger issues.

During the first EU Safeguard quota window that ran from 19

July 2018 to 1 February 2019 with an allowed quota level on hollow

sections of 387,343 tonnes for all non-EU suppliers. (The whole quota was

fully utilised).

The second EU Safeguard quota window runs from 2 February

2019 to 1 July 2019 but this time the quota is broken down by

country at the following levels.

| Country |

Tonnage Quota |

| Turkey |

154,436 |

| Russia |

35,406 |

| Former Yugoslav Republic of Macedonia |

34,028 |

| Ukraine |

25,240 |

| Switzerland |

25,265 |

| Belarus |

20,898 |

| Other Countries |

25,265 |

Our general concerns are:

1: The Turkish hollow sections quota is set at a low level

as it is based on a 3 year average trade level pre July 2018. In more

recent times Turkey has been a much more dominant supplier to Europe as Trump’s

50% import tariff on Turkish hollow sections effectively shut the door on

Turkish hollow sections exports to the USA. The Turkish EU Safeguard

quota is therefore expected to be utilised very early in this new window.

2: On 2 January 2019 many traders throughout Europe were

known to be bonding Turkish hollow sections just like All Steels Trading so we

believe that a huge loading against the allowed allocation is already in place.

3: It is also known that many traders have attempted to

front load the quota window just like All Steels Trading and have shiploads due

to arrive over the coming months. Again the number of such ships already

on the high seas heading towards Europe is known to be large and as each week

drifts by the chances of being hit with a 25% duty as the quota gets exhausted

becomes a huge danger!

4: The EU commission are struggling to reconcile

tonnage receipts due to the added complexity of also setting tonnes by

country. At present we have no visibility of where imports are against

the set quotas for any product and we are being advised by the commission that

it could take up until 19 February 2019 for them to get their system up and

running. All traders are therefore running blind with the risk of

retrospective duty charges being a real possibility on goods already imported

on certain products.

With such confusion All Steels Trading is finding it

impossible to buy non EU hollow sections for the sale of such goods prior to 1 July 2019.

If we bought more hollow sections today from Turkey we

either run the risk of paying out a 25% duty on arrival or if timing allows

putting such new material in bonding until 1 July 2019, which would

ultimately leave us letting customers down and incurring huge incremental

financing and warehousing costs. The bottom line is therefore on sizes

where we already have zero stock or zero remaining availability on our February

2019 ship this will remain our position until 1 July 2019. We

would also add that we are already seeing a high level of sales so we do

believe our stocks will soon become depleted.

We trust that you will appreciate this update and if you

have any queries please give me or one of All Steels Trading’s sales team

members a call.

Best regards

Laurence McDougall