Dear Customers

In our stock offer of the 29th November 2012 we conveyed a number of factual events that signalled a warning that steel prices would rise. (A copy of the latter mail is copied below).

In this New Year message we must warn you as a valued customer that changes in world iron ore spot prices are surpassing our previous warnings and increasing at an alarming rate.

As a relatively small trading operation in the UK we can’t provide a full explanation for these changing conditions but key influences are understood to be as follows:

· Iron ore mining was significantly cut back in the latter half of 2012 as demand substantially weakened.

· Numerous new iron ore projects were mothballed as concerns increased with regards to anticipated weak demand and falling prices.

· Stock levels at Chinese ports tumbled by the end of 2012 to a 2 year low as the market expected further price deterioration.

· Some of India’s largest mines were closed down by governing bodies due to corruption related issues.

· Large numbers of Chinese iron ore mines significantly cut back production as steel plants went into a big stock reduction programme.

It would now seem that the supply balance tipped far too low just at a time when buying and production activity in China has reignited thus resulting in a huge iron ore price escalation.

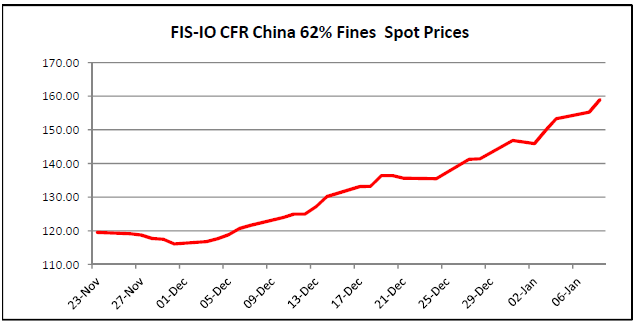

Since the end of Q3 2012 spot iron ore prices have nearly doubled.

i.e. CFR Chinese price for iron ore 62% fines (the key ingredient for steel making), has increased from $85p/tonne to $160p/tonne as of last night.

In the last 7 days the price has been rising by as much as $5p/tonne per day!

As of now we are also seeing World scrap prices quickly increasing to reflect the changing iron ore situation.

The graph below shows iron ore price changes over the last 6 week period:

In the short term this escalation looks set to continue and all our steel suppliers are having to react to this changing situation so we are faced with big increases on replacement stock especially on beams, columns, HEBs, PFCs and angles.

Please therefore be warned that you will see an immediate impact on new prices that we can offer as of today. Based on current visibility we cannot see this changing in the immediate months ahead.

If anything price escalation and tightening availability is simply going to increase.

Naturally we have reflected the changing situation in our advertised prices.

Please also note that our selling prices for beams and columns also now reflect the size extra differentials introduced by the UK's domestic producer, which we expect the market place to fully adopt from the start of this new year.

If you have any questions with regards to this message please give us a call and we will try to provide any further clarity.

Best regards from everyone at All Steels Trading Ltd.