Dear All Steels Customers,

A fair number of you have recently been asking for All

Steels’ opinion on market developments based on our international trade experience

and contacts. Hence, rather than potentially repeating the same current message

many times over here is our view on trying to make sense of steel trade in the

UK in these unprecedented times.

Everything said below has to be tempered with a belief that

demand will slow down and it could even fall off a cliff edge if forced

self-isolation and social distancing measures continue for most of 2020.

My opening section really just addresses the raw material

cost fundamentals on steelmaking, but as we all know it is supply and demand

that always has the hardest bearing on steel prices.

As you can see from the selection of graphs below iron ore, coking

coal and scrap prices remain relatively high, and with the knowledge that virtually

all steelmakers are losing money we can take some comfort that steel producers

simply can’t afford to cut prices:

Iron Ore

Prices clearly remain firm and the recent stabilising in

price is reportedly resulting from the Chinese heavily returning to buying as

they resume normal production.

The acceleration on prices at the start of 2019 leading to

the June 2019 peak was primarily caused by major output cuts in Brazil

following the collapse of a major dam at Vale’s Córrego do Feijão mine. This

followed with closure of many other Brazilian mines due to concerns over the

structure of their tailings dams. Production has remained slow to recover, so over supply has been avoided.

1.7t of iron ore is used to make

a tonne of steel.

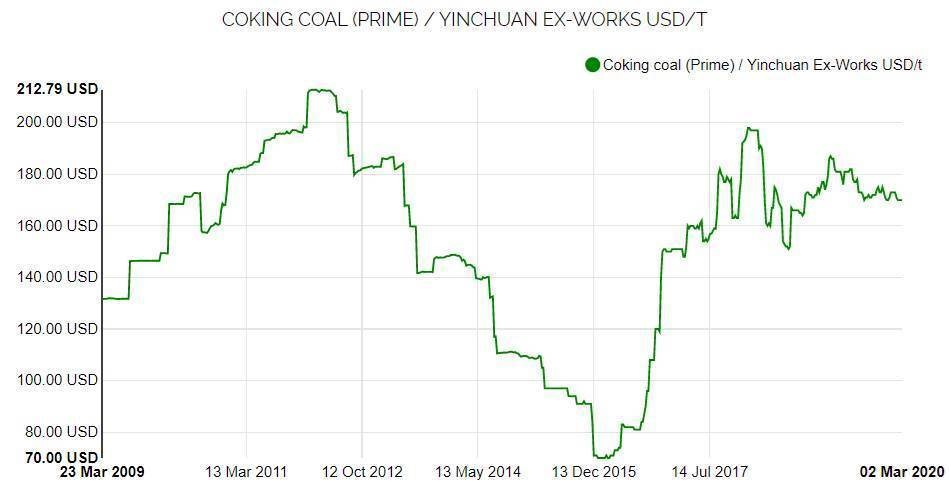

Coking Coal

Whether you are looking at Australia or China, metallurgical

coking coal prices all follow a close trend.

The peaks usually arise at the time of monsoon weather

conditions and resulting heavy floods in Australia.

Over the last few years prices have been in a more stable

band of $160-185 per tonne and have remained relatively flat since the start of

this year.

0.7t of coking coal is used to

make a tonne of steel.

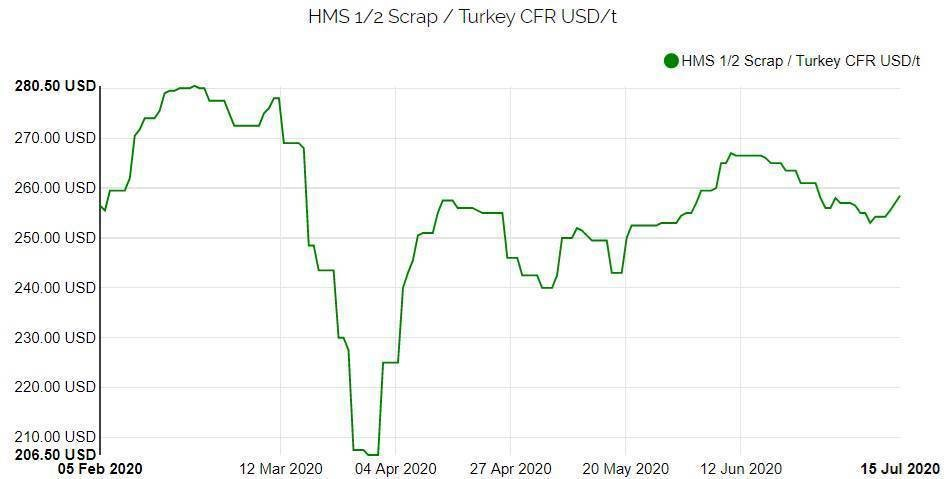

Scrap

Turkish imported scrap prices are always most reactive to

supply and demand and whilst prices have tumbled circa $35-40 per tonne over

recent weeks, they still remain much higher than the early October 2019

position. The downwards trending of scrap was expected to continue, but

the tightening up of availability from US Ports as they go on lockdown is now

becoming a constraint on supply, so this trend could reverse.

1.1t of scrap is used to make a

tonne of steel.

Another big influencer of UK steel prices is obviously

exchange rates and the message here is clear to see.

Exchange Rates

Since the onslaught of the coronavirus the value of the £

has taken a tanking with the loss of circa 10% of its value.

Whether it is raw materials for the UK steelmakers or

imported steel this movement is dramatic adding circa £50 per tonne of price

growth to steel with a typical price tag of £500 per tonne.

All shipping and road transport for deliveries to the UK are

also Euro or US$ based, so this is again adding big additional costs to

imported prices.

PRODUCT REVIEWS

The pricing dynamic by product are quite varied, so in this

second section I have tried to give All Steels’ true view on how we see trade.

Merchant Bar

In the UK we are blessed with a good volume of domestic

mills including Bromford Iron, Celsa UK, Liberty Merchant Bar, etc, but all

these mills have the reverse benefit on exchange rates with a 10% sterling

return gain on Euro selling prices.

Moreover, two of the most prolific producers of merchant bar

in Europe (Beltrame Italy & LME France) are both on coronavirus lockdowns

for manufacture and despatches. There are also many other small family merchant

bar mills in southern Europe that are also known to be closed. This is creating a huge mainland European demand for our

domestic mills whilst a hole is left in import supplies to the UK from Beltrame

and LME. This has resulted in Celsa UK applying £50 per tonne of increases on

deliveries this coming week (£25 per tonne on Monday 23-3-20 + £25 per tonne on

Thursday 26-3-20).

Our other domestic mills are also applying increases,

but demand is really tight and providing demand holds up more dramatic

increases seem inevitable. We also can’t rule out the risk of the domestic

mills suffering the same fate as LME/Beltrame. The chances of the latter has to

be high as it does not take too many key operatives to be absent for a mill /

steel plant not to function.

Hollow Sections

There has been an abundance of hollow section availability

with so many purchasers buying so heavily to beat EU Safeguards against the

Turkish supply quota that got exhausted much quicker than anticipated in

mid-February. Dock stocks do remain relatively high and All Steels also heavily

front loaded to beat Safeguard quotas, but the holes are just starting to

appear in our hollow sections stock range.

With no prospects of Turkish imports

being possible until the new Safeguard quota window opens on the 1st July supply has to tighten up as we step through each month in Q2. It is also

worthy of note that Italian imports will clearly become more difficult with the

coronavirus constraints on both production and logistics. With respect to

replacement prices out of Turkey current prices are high due to the weak value

of the £, so domestic prices in the UK have to rise over the next three months,

but this will be somewhat curtailed by an anticipated weakening in demand.

Structural Sections

This is another product where stocks have remained high in

the UK as everyone bought heavily in anticipation of price increases

pre-Christmas and then demand suddenly weakened. The price increases had all

failed by the time we entered February, but two factors will come into play on

forward supplies.

1. Virtually half the UK supply is satisfied by EU imports and the 10% devaluation of sterling against the Euro must end up being reflected on import prices.

2. Over the weekend ArcelorMittal has declared a force majeure on raw materials supplied to its European steel mills. This signals a strong message on the likelihood of further mill closures. The likes of Duferdofin Nucor, Italy’s largest section producer is already closed and more must follow. When one of these mills goes down it leaves a huge hole in the supply chain. When more than one mill goes on lockdown availability will become analogous to trying in vain to purchase a fair share of necessary toilet rolls from one of Britain’s supermarkets!

These are only All Steels’ views, which we have generally

been asked to share. However, we hope this provides you with some useful

guidance on what is most likely to unfold in these difficult business times.

Stay safe.

Best regards,

Laurence McDougall

Managing Director