Dear All Steels Customers,

Changes in the steel market certainly continue to move at significant

pace, and the forecasts we predicted in our mid-August note have very much all

now come to fruition. Hence, many of our customers have been asking for

our considered view on the current and foreseeable market situation, so here is

another relatively succinct update on observations, and our forecast for the

most likely changes ahead.

Understandably the resurgence of Covid-19 is causing further

confusion and uncertainty for us all. However, it is also fair to say

that most countries around the world seem to be taking the stance that the

industrial world cannot be allowed to suffer, and construction markets all

appear to be strong as governments advance their infrastructure projects to

assist employment. “The Get Britain Building Campaign” certainly still

looks to be a top initiative in the UK, and if we look at the sales statistics

produced by the National Association of Steel Service Centres (NASS) it is

evident that demand for structural sections, merchant bars and hollow sections

have returned back, indeed since July, to pre Covid-19 levels.

Our own UK rolling mills are also very busy and overtime

working is now starting to be applied to keep up with demand, so the speed of

positive turnaround of our industry from being in a rather dark place in the

spring is quite extraordinary.

For simplicity, we have started off by updating the usual

graphs, which we last presented to you in mid-August, and that we typically

follow on a daily basis as it is these fundamentals that drive steel prices

combined with supply and demand.

Iron Ore

Iron ore prices clearly remain

strong. Recent concerns have been expressed that increased mining

capacity coming on stream would result in a price softening and whilst the bull

run came to a halt in mid-September prices once again seem to be on an upward

trajectory.

China's crude steel output is now

estimated to exceed a record breaking 1 billion metric tonnes this year.

What is evident from media reports

is that China’s crude steel production has been running at very high levels

since May with consumption being lifted by the country’s infrastructure boom,

and underpinned by their manufacturing sector. Such activity is probably

now sufficient to keep iron ore hovering around its current high levels.

When considering ratios of iron ore

usage to the manufacture of steel it cannot be ignored that this element alone

is adding circa £52 per tonne to BOS route steel-making costs since the end of

April’s low point!

1.7t of iron ore is used to

make a tonne of steel.

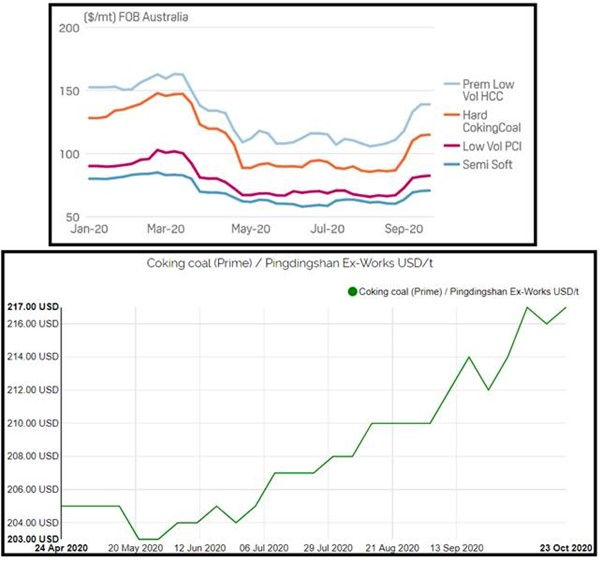

Coking Coal

Like most commodities coking coal

prices recovered sharply following the first wave of the Covid-19 pandemic.

As seen with iron ore, Chinese BOS

route steelmakers are producing crude steel at a rate of knots with daily

output records being recorded in September.

With such strong demand coking coal

prices must logically stay strong, which the graph reflects from one of China’s

major domestic sources.

The top graph also shows FOB

Australia prices that are a good illustration of the recovery following the price

decline at the end of Q1.

Moreover, only this week severe

heavy rainstorms and floods are once again making headline news in Australia’s

major mining territories, and we all know what impact this can have on both

iron ore and coking coal prices.

0.7t of coking coal is used

to make a tonne of steel.

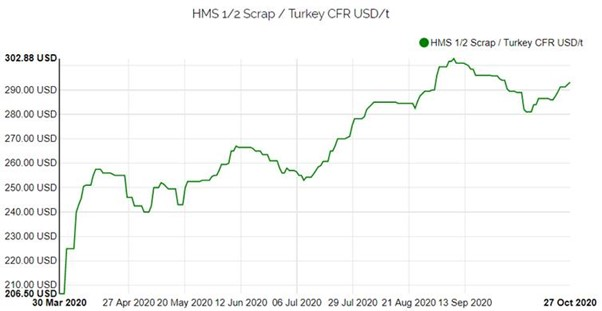

Scrap

As expressed in previous steel

bulletins Turkish imported scrap prices are always the most reactive to supply

and demand and other world steel events.

The graph therefore naturally

depicts general steel price movement and little explanation is required to

where steel prices appear to be trending.

Clearly iron ore and scrap prices

are currently moving in tandem, so both electric arc and BOS route steelmakers

both face the pressure of rising costs.

Unsurprisingly, Europe and UK scrap

prices are generally moving in the same upward direction, so there is no

geographical immunity to such increases in steel-making costs.

We also picked up news yesterday

that the Chinese are reappearing in the world market buying up scrap and this

could cause a serious uplift in scrap prices.

1.1t of scrap is used to

make a tonne of steel.

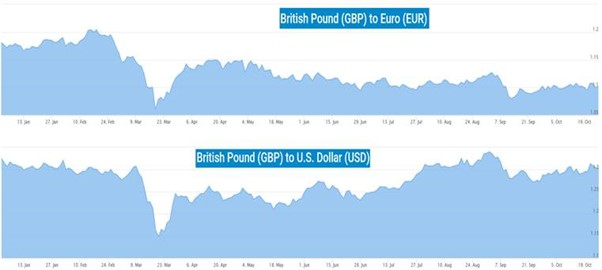

Exchange Rates

The £ sterling recovered quickly from

the initial shock of the Covid-19 outbreak, but it still remains weaker than

its year opening position especially against the Euro. Such an outcome

only serves to firm up imported steel and steel-making raw material costs.

In an environment where we have

American elections and Brexit negotiations closer to home it will be a volatile

time for the £ sterling, and we would shortly expect to see some significant

movement, but the direction is currently too difficult to call.

If you look at the value of the £

sterling against the Euro in particular, which is most relevant to the UK, the

devaluation of the £ sterling here has added circa £36 per tonne to imported

steel costs from mainland Europe since the start of the year.

All shipping and road transport for

deliveries to the UK are also Euro based, so this is also adding additional

costs to imported prices from the EU.

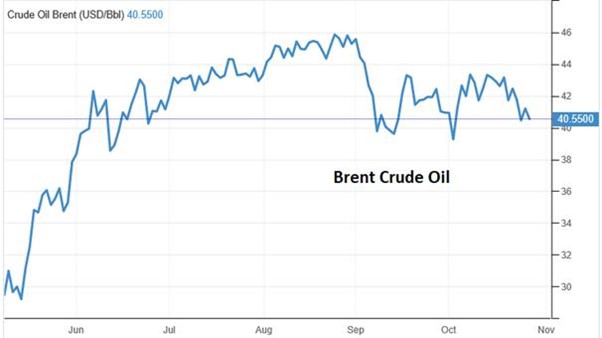

Oil Prices

As is usually the norm the oil

price mirrors the world’s general economic trends.

It is certainly reflective of what

we have seen in the UK, with June and July showing the strong bounce back we

have seen in steel demand.

It equally shows some confusion in recent months

as the Western world wrestles with further uncertainty of the Covid-19 second

wave.

On balance, we would say it shows improved confidence in the economy.

Whilst all these graphs convey a positive message for

strengthening steel prices the same health warning applies again here that the

Covid-19 pandemic could return to ultimately bite more severely as we progress

through the cold winter months ahead.

In the section below, we have tried to give a short overview

on each product group. The underlying message however is that from the

selection of graphs above is that everything is pointing towards a necessity

for steel prices to keep on increasing, especially when you combine this with

the knowledge that virtually all steelmakers are still losing money.

Evidence would therefore suggest that we will continue to see mill price

increase announcements.

PRODUCT REVIEWS

Merchant Bar

Merchant bar prices are now firmly up by £40 per tonne with

all the major domestic and European players having successively implemented a

second round of increases since the summer. Rising raw material costs are

the main drivers, but the tightness in supply is continually forcing buyers to

source many infill purchases from the wholesale market and consequentially

radically increasing their costs by an extra measure. Looking at the

overall picture you basically get the impression that all mills cut back shifts

and associated labour to deal with the early impact of Covid-19 and whilst

demand has returned there has been a reluctance to re-recruit in fear of

further Covid-19 pandemic setbacks. The effects of the Covid-19 pandemic

have also forced the closure of another producer i.e. an Italian merchant bar

producer (Cogeme) and the resurgence of the Covid-19 pandemic is again creating

disruption to manufacture. Even our own Bromford mill is currently taking

some necessary manufacturing time out due to a small-scale Covid-19 outbreak

and this issue is evidently most likely to become an even bigger manufacturing

impediment for all EU producers.

We have certainly never witnessed supply being so tight on

merchant bar, and at present we simply cannot see any immediate change in this

situation. Against this background if we do see the slightest uptick in

scrap prices, as anticipated, further price increases have to be on the agenda

especially when you consider that the increases applied to merchant bar to date

fall some distance behind the movement we have seen on both hollow sections and

structural sections.

As a business our own merchant bar stock for infill supply

to stockholders has been heavily depleted, and we are struggling to replenish

at the desired pace, and nothing on the horizon is going to allow us to correct

this situation. Container shipments out of Turkey also remain extremely

dangerous due to the Safeguard issues with no practical solution to bonding the

boxes should quotas get exhausted. We therefore cannot see a simple

solution for quickly filling our stock gaps.

Hollow Sections

As mentioned in August imports have always largely satisfied

the UK market and whilst the new quarterly quota system was introduced to

better stabilise the spread of imports throughout the year it has added another

complexity and risk to hollow sections traders. The quota for the October

to December period was actually exceeded on the first day of this trading

period by 6,000t and all importers could be subjected to a retrospective HMRC

C18 post clearance demand. This demand could, by all accounts, be

inflicted by HMRC at any time over a three year post the initial clearance

follow on period.

Needless to say, availability is tight and bonding has once

again had to be used by many importers’ ships that arrived after the 1st October to avoid duties. Such constraints will be an ongoing problem and

arguably the new individual UK Safeguard quota will tighten up supply even

further with new measures coming into effect on EU imports of the

product. At present the limit for EU imports is set at only circa 10,000t

per quarter and with many EU deliveries being made on trucks supplying the UK

from the 1st January 2021 will become extremely arduous and high

risk never mind deterring many suppliers away from the UK. Some of the

quotas set for mills outside the UK and Turkey also appear to have been set at

very low levels especially for the likes of the UAE, which has been a

significant supplier to the UK market over recent years.

The perfect storm on hollow sections supplies is therefore

likely to worsen and the prices in the marketplace from domestic mills and dock

stock sellers reflects what is an unbelievably tight situation. Price

increases since the summer of over £200 per tonne are commonplace and whilst

some traders will no doubt sell forward at cheap rates they will be potentially

playing with fire with respect to HMRC imposing a C18 regulation. Another

additional problem is that with so much hollow sections being bonded in preparation

for clearance on the first day of each month dockside warehousing is in real

short supply and simple economics is forcing up the cost of such storage for

the traders.

With such huge obstacles and trading risks in play a number

of traders have already called it a day and very few imports will escape some

duty charges over the quarters ahead. As a trader, we are trying to

minimise the risk for our customers by heavily bringing in supply well in

advance of each quarter and accordingly bonding material for customer clearance

on the first day of each quarter. Warehousing however restricts the

volumes we can trade and therefore our own sold stock positions are being

greatly reduced. On the price front it will be availability more so than

raw material price movement that will influence price movement and with

availability being set to remain in very short supply it is logical for prices

to remain exceptionally high. Hence, there is really no ceiling as to

where prices could go given the immediate circumstances.

Structural Sections

The National Association of Steel Service Centres' sales

statistics on structural sections strongly reaffirms that “The Get Britain

Building Campaign” is a reality with September daily sales being in line with

the average for Q1, Covid-19 pre-pandemic. Similar to all other products

mill supplies are all running late and there is serious confusion for the EU

mills on how to service the UK post the 1st January 2021 following

our separation from the EU. Customs clearance becomes a new requirement

in the process, but the bigger concern is that EU Safeguards becomes a new

obstacle and whilst these have been tabled in the event of a Brexit Deal the EU

has still not reciprocated with quota arrangements for UK exports to the EU.

In the event of a no-deal Brexit the proposed UK Safeguards immediately get

thrown out of the window, so at this very late hour nobody is clear on the

terms of engagement with EU section mills. With such lack of clarity, it

is possible that EU suppliers will take a trade break for supplies to the UK

during January or until such time that we get further clarity.

With regard to price, we have seen £60 per tonne of price

increases since the summer months (2 x £30 per tonne) all of which appear to

have been fully implemented, but prices have still not got back to levels seen

this time last year even though raw material prices are higher. It

therefore seems apparent that the mills still need to make further price

increases and with supply remaining tight and raw material prices appearing to

be still driving upwards it is highly likely that another sizable official

price increase will be announced shortly.

Please note that these are only All Steels’ views, which we

have generally been asked to share. However, we hope this provides you

with some useful guidance on how things are in our professional opinion most

likely to unfold.