Dear All Steels Customers,

It was certainly a difficult second quarter for all steel

producers, and our own rolling mills took their fair share of lockdown time as

demand sharply fell away. Thankfully both Bromford Iron and Special Steel

Sections have been back in business since the start of July and demand

continues to slowly improve. On the trading side of our business many

customers are asking for our view on the market as a multi-product trader, so

here it is based on the usual fundamental hard facts that normally drive steel

prices.

When I looked back at my last circulation I mailed out in

mid-March I was pleased to see that I logically opened my message with the

following statement:

“Everything said below has to be tempered with a belief

that demand will slow down and it could even fall off a cliff edge if forced

self-isolation and social distancing measures continue for most of 2020”.

Understandably the same health warning applies again, but

hopefully we are on the road to recovery in most respects.

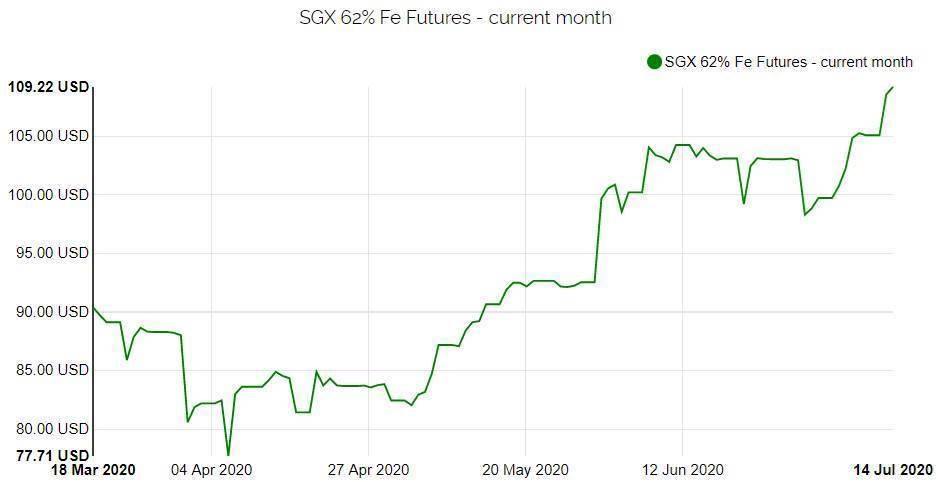

My opening section below really just addresses the raw

material cost fundamentals on steelmaking. As you can see from the

selection of graphs everything is pointing towards a necessity for steel prices

to increase, especially when you combine this with the knowledge that virtually

all steelmakers are losing money. Evidence would therefore suggest we

must be hitting a bounce back point.

Iron Ore

Mining commodity prices fell nowhere near the levels

anticipated, primarily because of China’s quick economic recovery. Moreover,

Chinese demand has continued to strengthen at a time when Brazilian mines have

almost ground to halt as a result of large Covid-19 outbreaks amongst the

mining communities.

Brazilian output will eventually return but in the short to

mid-term the maths is simple to do.

A $30pt iron ore cost increase is just not possible for a

steel producer to absorb so BOS route steel prices must rise.

1.7t of iron ore is used to make

a tonne of steel.

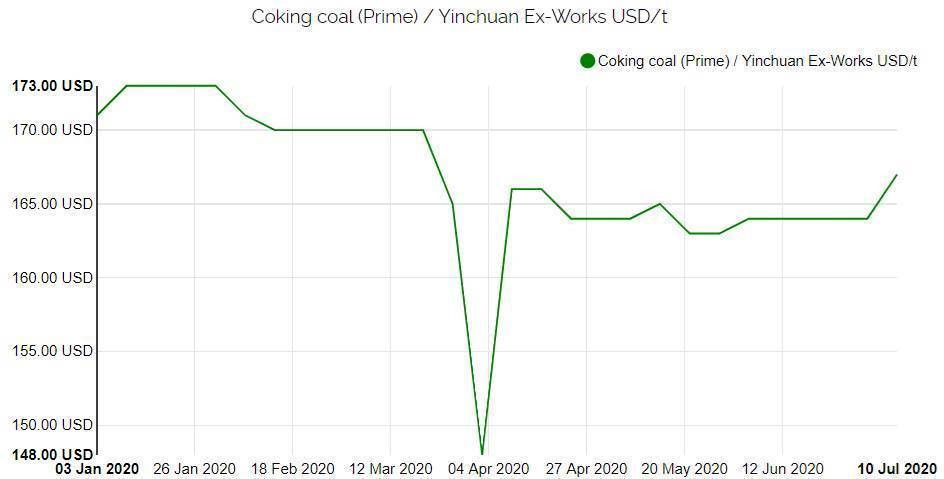

Coking Coal

As more metallurgical coking coal production has been

concentrated in Australia, prices have been more influenced by extreme weather

over the last decade rather than supply and demand. The onslaught of

Covid19 however did take its toll on coking coal prices, but the dip was

clearly short lived as the graph shows.

Evidently coking coal prices are now within $2p/t of

pre-crisis levels. There is also a lot of new speculation pointing

towards rising prices off the back of many mining giants’ decisions to

significantly cut capacity.

0.7t of coking coal is used to

make a tonne of steel.

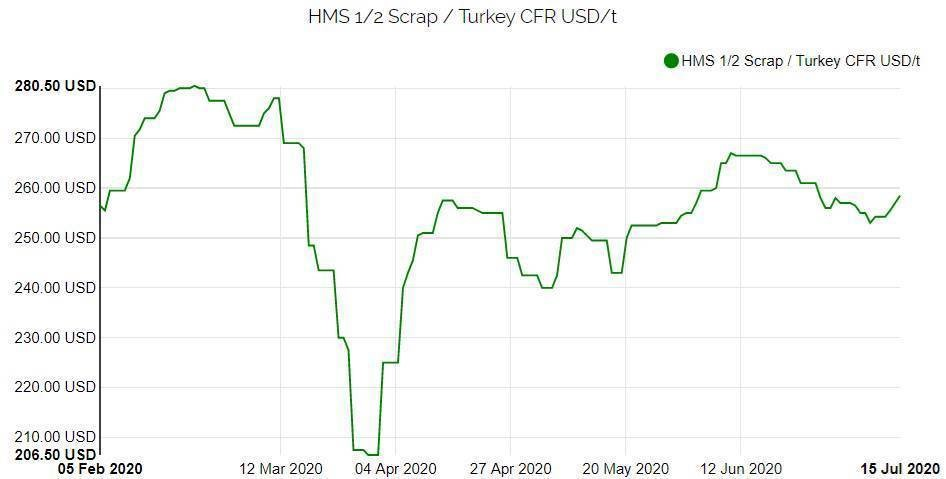

Scrap

Turkish imported scrap prices are always the most reactive

to supply and demand and general world events. Clearly, we are seeing a

common theme with scrap prices having hit rock bottom in early April followed

by a sharp recovery.

Against expectations of a July scrap price fall the opposite

now seems to be the reality.

The same outcome is also being mirrored in both the UK and

mainland Europe. Scrap route melters are therefore facing equal cost

pressures to that of the BOS route steelmakers!

1.1t of scrap is used to make a

tonne of steel.

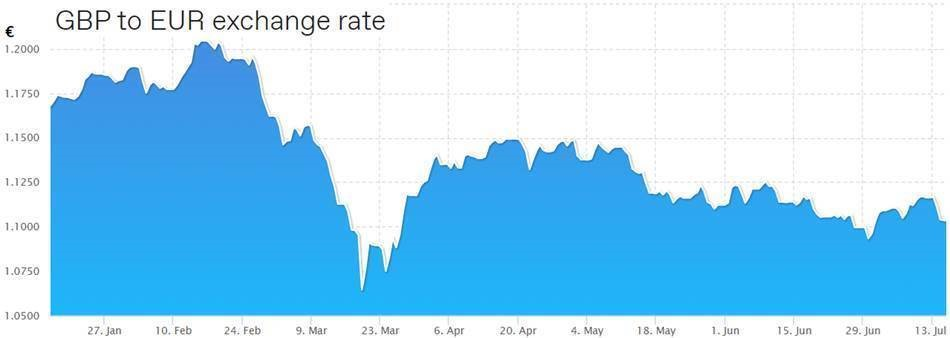

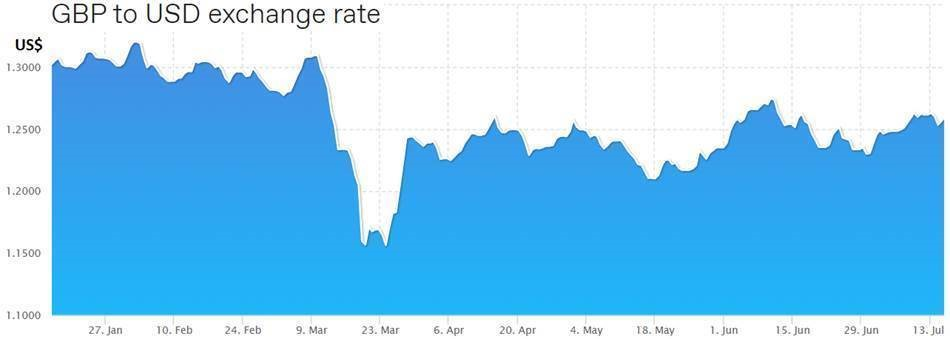

Exchange Rates

As Covid-19 took a stranglehold in the UK at the end of

March the £ took a thumping and lost circa 12% of its value.

Again, the recovery here was relatively quick, but it still

remains much weaker against both the Euro and the US$ than its position at the

start of the year.

Whether it is raw materials for UK steelmakers or imported

finished steel this devaluation is significant. Since the start of the

year the currency effect alone is adding circa £35-£40 per tonne to steel

imported from mainland Europe.

All shipping and road transport for deliveries to the UK are

also Euro or US$ based, so this is also adding additional costs to imported

prices.

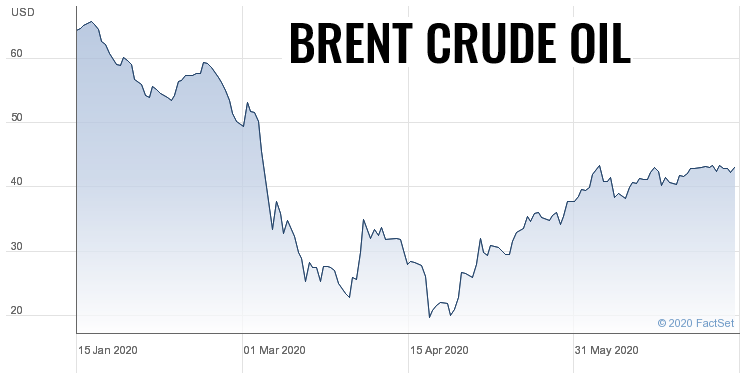

Oil Prices

A notorious rule of thumb is to use oil price trends as a

barometer for steel price movements.

Despite our move to green steel oil generally still has a

bearing on steelmaking energy costs, so this again has an impact on prices.

In general, however oil prices are usually just a reflection

of the economic world and without surprise this is pointing to a position of

improvement.

PRODUCT REVIEWS

The pricing dynamics by product are quite varied, so in this

second section I have tried to give All Steels’ true view on how we see trade.

Merchant Bar

Domestic over capacity for today’s UK market remains a

constant problem and the imbalance on supply and demand has already taken its

toll once again on merchant bar prices. As we have all seen in the media

the mills have been pushing hard for Government loan assistance and some

support has been granted, but these are loans at a cost that have to be paid

back. On a positive note, I am sure the weak value of sterling will be

assisting exports, but current domestic prices cannot be sustainable for the

mills.

At the outbreak of Covid-19 most of the mills took the brunt

of the costs as they were left with the financing of stock as many

stockholders/consumers simply closed. The mills naturally cut back

capacity and discounted prices to encourage some sales, but the balance now

seems to have been addressed. Stockholders have called in the mills’ aged

stocks, mills and traders dock stocks have been heavily depleted, and we have

finally reached the mills’ extended summer shutdown periods.

Everything therefore suggests a tightening in supply and a

much busier period on their return from summer breaks. Given all the

other steelmaking cost factors referenced above price increases must be on the

mills’ agendas.

Hollow Sections

As EU Safeguard quotas became exhausted mid-February it was

almost guaranteed that hollow section investors were going to get a very nice

margin return in Q2. Once again this was another one of those lessons

that nothing is guaranteed in the steel industry.

Demand fell off a cliff and Turkish prices collapsed, and

the new July Safeguard quota window quickly opened. As buyers have

understandably returned in a cautious mode there has been a reluctance to

forward order. Mill stocks and dock stocks have suddenly become heavily

depleted and shortages are now evident on many popular sizes. This

coincides with Tata UK announcing a £50 per tonne price increase on HRC that

logically must wash through into hollow section prices. From All Steels’

experiences we are also seeing similar changes in our Turkish buying prices

especially when you factor in the adverse foreign exchange.

Hollow sections has always been one of those products of

feast or famine with consequential dramatic price swings, and at present it

looks like we are entering a window of famine!

Structural Sections

The Jingye Group’s acquisition of British Steel literally

happened as UK manufacturing slammed on the brakes and went into

lockdown. Miraculously British Steel Sections has managed to plough on

regardless and appear to have spanned the world to find the necessary sales to

keep their mills rolling. This was clearly a set out intent of Jingye to

maximise plant utilisation as a first priority to improve competitiveness, and

I am sure they will have recovered UK market share. Even with such efficiency gains however the

rising costs of steelmaking ingredients have surely reached a point where they

can no longer be ignored.

It also has to be recognised that “The Get Britain Building

Campaign” appears to be a top priority Government initiative, so this has to

bode well for structural steel demand. The coming together of these

developments would therefore appear to be good timing for a recovery in steel

prices, and British Steel has already formally announced a €30 per tonne price

increase to its European customers. An increase on structural section

prices for the UK therefore has to be just around the corner!

These are only All Steels’ views, which we have generally

been asked to share. However, we hope this provides you with some useful

guidance on how things are most likely to unfold in what will hopefully prove

to be a time of recovery for all concerned in our industry.

Keep staying safe!