The

impact of globalisation and geopolitical tensions on the steel industry are set

to be more pronounced than ever in the year ahead. President Trump’s decision

to impose substantial steel tariffs on nearly all nations has far-reaching

consequences, which will only intensify as other countries introduce similar retaliatory

measures. The inevitable outcome of this scenario is a resurgence of inflation

and rising steel prices.

Here

in the UK, liquid steel output has currently reduced to circa 3 million tonnes

per annum, while consumption stands at approximately 12 million

tonnes—highlighting the country’s heavy reliance on imports.

At

All Steels, our primary focus is on long products, and so the main focus of this

note aims to provide our customers with an insight into expected price

developments for structural sections, merchant bars, and hollow sections.

Notably, 86.16% of UK imports for these products come from the EU and Turkey.

The anticipated market shifts are already taking shape and could escalate rapidly.

Already

in the UK we have recently seen £20-30 per tonne of price increases applied by

most European producers of long products but it is All Steels’ view that this

is only the first wave of such hikes. Our concerns and observations are initially

focused on ferrous scrap as this is where the impact of Trump’s tariffs are

most noticeable.

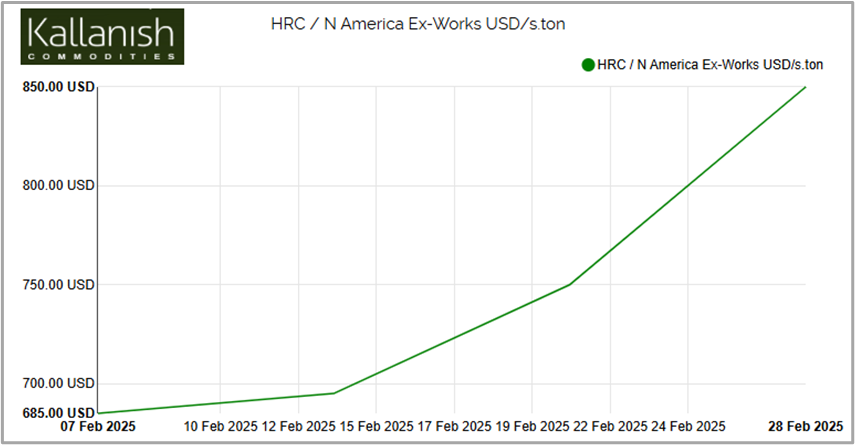

In

the US, protectionist measures have already enabled domestic producers to raise

steel prices on certain products by $165 per tonne during February 25

and the US scrap producers are wasting no time in taking a slice of this

increase as well as enjoying the uptick in local demand. The graph below, featuring

Kallanish published data on North American Hot Rolled Coil Mill Ex-Works Prices

in US dollars, serves as a strong indicator of price trends.

Trade

flows are already shifting in response to this situation, with Turkey being the

hardest-hit country due to its status as the world's largest buyer of American

scrap. In 2024, the US exported 13.38 million metric tonnes of scrap, with

Turkey accounting for a significant 4.41 million metric tonnes.

Trade

flows are already shifting in response to this situation, with Turkey being the

hardest-hit country due to its status as the world's largest buyer of American

scrap. In 2024, the US exported 13.38 million metric tonnes of scrap, with

Turkey accounting for a significant 4.41 million metric tonnes.

As

a result, Turkish steel producers are left with two main options:

1: Pay a premium for US scrap, which is expected

to rise in line with increasing US domestic prices—a trend that is already

evident.

2: Source raw materials from alternative markets,

and increased buying activity from Europe is already evident.

The

latter scenario is already tightening scrap availability in Europe and as this

supply and demand balance switches prices are naturally increasing.

Over

the coming months it is also likely that we will witness cuts in both UK and EU

Safeguard quotas, dramatically heightening the risk of 25% import duties,

especially on merchant bars (including angles) and structural sections. We also

have the introduction of CBAM (Carbon Boarder Adjustment Measure) on the

tailwinds, which as a standalone event will create one of the biggest upshifts

in UK steel prices.

The

All Steels strong message to all our customers is therefore to increase

awareness of rising prices over the months ahead and as of this morning we will

be applying a £20-30p/t price increase across most of our stock items. What is

also important to note is that we are starting this journey from a very low

stock base throughout the supply chain so demand is likely to jump quite

quickly as buyers make their moves to beat price increases. Here in the UK, we

are also of the belief that government infrastructure spending is truly ready

to begin so this will also fuel much needed improvements in demand.

It

has been a long-drawn-out trough of weak steel demand and prices but All Steels

firmly believes that we are at that turning point where we all need to be

prepared for price escalation that now looks unavoidable.