Dear All Steels Customers,

This is a relatively short note intended to provide you

with an update on the key outcomes relating to predictions we made in our 23

April 2021 UK Steel Market Evaluation Report.

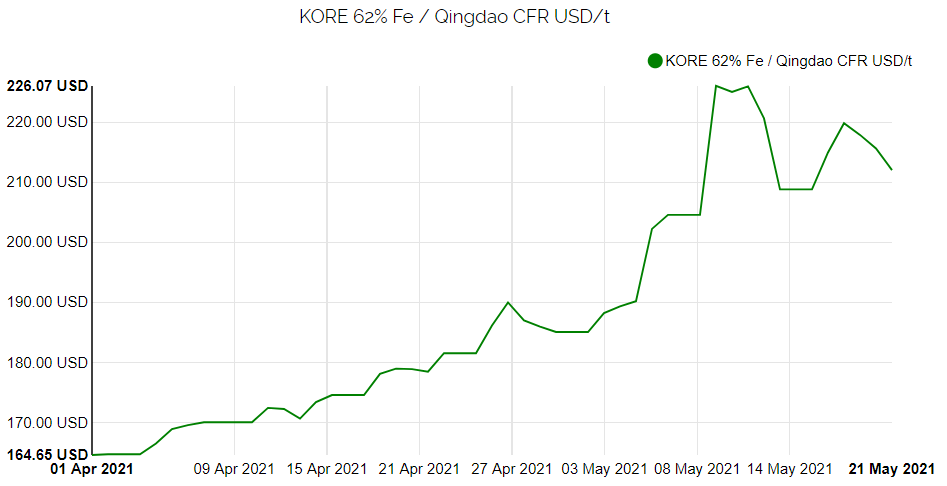

Steelmaking Raw Materials

Virtually all raw materials continued on an upward

trajectory, as anticipated, with record-breaking price levels being

reached. In our previous note, we reported iron ore levels breaking the

US$180 per tonne barrier (KORE 62% Fe/Qingdao CFR) and for the last fortnight,

the rate has capitulated at a new record-breaking high in the band of US$208.84

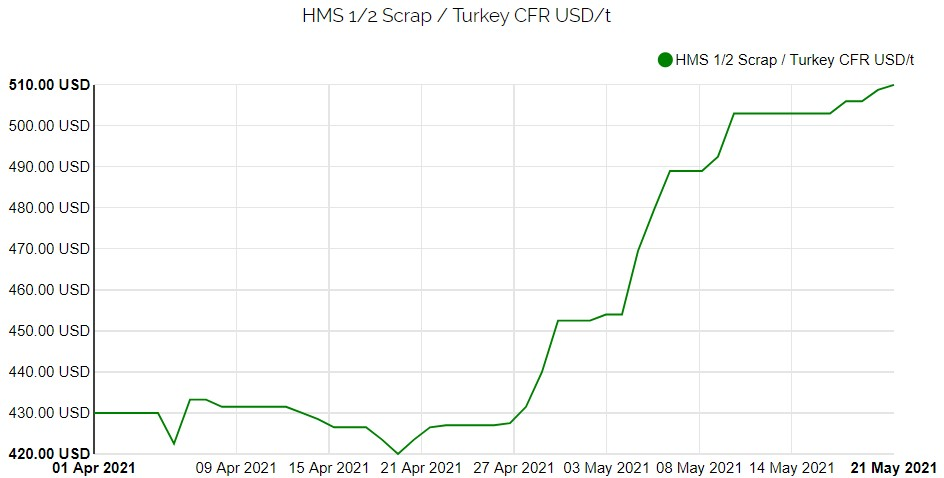

to $226.07 per tonne. As you would expect scrap prices also followed this

move growing from US$427 per tonne to US$510 per tonne (HMS1/2 Scrap/Turkey

CFR).

The two graphs below showing this move requires little

explanation to understand the impact on steelmaking.

1: Iron Ore

2:

Scrap

Whilst the push on iron ore prices appears to have taken

some breathing space over the last fortnight the dynamics remain unchanged with

demand continuing to increase. Hence, the possibility of another price

run over the summer must now be a serious consideration. Similarly on

scrap the market is currently adjusting to the reality of the newfound high

prices but speaking to one of our main Turkish suppliers over the weekend they

remain deeply concerned that the price of scrap is likely to push on

again. The new concern on the horizon for Turkish steel makers is that

there is speculation that the EU will enforce scrap export taxes and there are

already reports of the Ukraine increasing its scrap export tax to 90 Euro per

tonne.

General Steel Price Movement in the UK

In our note of 23 April 2021, we strongly expressed the

likelihood of further price increases and this has happened at quite staggering

levels as summarised below:

Structural Sections

5 May 2021 – British Steel announced a £50p/t increase.

14 May 2021 – British Steel announced a plan / necessity for customer allocations to apply.

18 May 2021 – British Steel announced a further £100p/t increase.

18 May 2021 – British Steel announced a customer allocation system based on historical purchase levels.

4 May 2021 – ArcelorMittal announced a £40p/t increase.

17 May 2021 – ArcelorMittal announced a further £80p/t increase.

18 May 2021 – ArcelorMittal issued a rolling programme with restricted availability and notification of tonnage allocations to be applied.

At the time of writing this report virtually all other EU

producers have extended a period of not offering to the UK market due to

overwhelming demand in mainland Europe and the fact that scrap prices have not

settled down so there is a reluctance to offer forward.

As a reminder since the prices started to climb on the

current cycle from August 2020 British Steel has now actually applied a total

of £410 per tonne of price increases.

Merchant Bar

19 May 2021 – Liberty Merchant Bar announced a further £80p/t increase to follow up on a £40p/t mid-April price increase.

26 April 2021 – LME (Beltrame) announced a £20p/t increase.

14 May 2021 – LME (Beltrame) announced a further £80p/t increase.

Other suppliers of merchant bar do not make public price

increase announcements, but they have all applied similar price measures and

most have restricted availability.

As a reminder since the prices started to climb on the

current cycle from August 2020 Liberty Merchant Bar has now actually applied a

total of £310 per tonne of price increases.

Hollow Sections

Like merchant bar we do not see official price increase

announcements from domestic producers although at this present time we

understand that Liberty Tubes has temporarily ceased manufacture due to the

availability and price of hot rolled coil.

What we can advise however is that our buy price from

Turkey since 23 April 2021 has increased by a magnitude of U$250 per tonne

(£178 per tonne). In addition to this price increase, there is then also

a Safeguard duty factor which is unavoidable even when customs clearing on the

first day of each quarterly quota window and this is becoming more sizable as

the cost of hollow sections keeps rising.

As a reminder since the prices started to climb on the

current cycle from August 2020 Turkish Hollow Section Prices have increased by

US$670 per tonne from our own experience (£478 per tonne). However, you

then need to add increased shipping costs and a Safeguard duty impact, which

became a reality when UK Safeguard Quotas came into force on 1 January

2021. Both of these impacts are significant.

Supply & Demand

In our report of 23 April 2021, we made the point that we

were entering a new paradigm of market pressures where demand exceeds supply,

and it is fair to say that we are already now starting to see the consequences

of this situation. Over the past several days we have already witnessed

availability being more critical than price and given that we are now knocking

on the door of the mill summer shutdowns this problem is going to become even

more acute.

Speaking out as a trader a new phenomenon for All Steels

and probably many other businesses in the supply chain is affordability.

As a business typically holding 40,000-45,000t of stock with similar quantities

in the pipeline financed by letters of credit our substantially increased

banking facilities will simply not allow for such volumes to be

maintained. Hence, the only way to combat this is to reduce inventory

levels to an affordable level. It, therefore, seems inevitable that

whilst availability from the mills cannot keep pace with demand dock stocks and

probably stocks amongst the UK stockholding community will also tighten up even

further.

As the saying goes it, therefore, looks like we

are heading into a perfect storm that will inevitably lead to more

rationalisation/consolidation in our supply chain. Hence, it is now

totally unpredictable as to how long it will take for supply and demand to get

in balance and how far prices will rise in the intervening period. The

consensus is that unaffordability will eventually bring prices crashing back

down but at the same time, you can appreciate the logic that steel producers

can now see the benefit of keeping capacity tight, and with such huge costs of

bringing lost capacity back to life will any steelmaker wish to make such a

move? It is fair to say that many pundits had speculated that the rising

cost of copper would not be sustainable on the grounds of affordability but on

the London Metal Exchange the price of copper has increased from US$ 2,908 per

tonne in December 2008 to its current level of US$ 10,011 per tonne and demand

remains insatiable. Food for thought!