It is relatively easy to report on current and historical costs

of the physical ingredients that drive steel prices but this All Steels bulletin

steps over this boundary by making bold predictions on forwarding price direction. These forecasts are all logically based on

analytical trends, sentiment and anecdotal evidence collected from a wide base

of trusted industrial contacts.

At the outset of this year, the impact of Omicron created

massive uncertainty with such a high spread of infections. However, whilst this has most certainly curtailed

industrial consumption of steel during the early part of January, Omicron

aftereffects now appear to be fizzling out, which should allow a steel business

recovery.

It is still All Steels’ view that the rapid acceleration of

steel prices during January -June 2021 were totally justified as steelmaking

costs necessitated such price movement. When we reflect on the data

available however it is clear to see that a lot of the demand during this

period was artificial with companies throughout the industry re-stocking from a

very low base. True underlying demand

was therefore hidden and very much exaggerated by heavy inter-trade volumes

within the stockholding and dockside trading community. It was this

activity that forced steel prices up a notch too far over the summer and by

September steel traders and stockholders woke up to this reality, and demand on

the mills rapidly diminished causing a price softening. Much of Q4, 2021

was therefore a period of market correction as the industry tried to rebalance

stocks to reflect true underlying demand and we believe it is fair to say that this

correction process is still spilling over into Q1, 2022.

It is also worthy of note that as part of this stock

rebalancing process many mills did cut back capacity during Q4 and are still

operating at reduced levels, so the supply and demand balance is not too out of

kilter, and this is what has helped to avoid a boom-and-bust cycle like

historical experiences. As previously expressed, it is always the supply

and demand balance that dictates prices, and therefore we saw rates softening

in Q4, but the All Steels current view is that sentiment has largely

improved. Moreover, stocks will get into balance by the end of February

2022 and with the impact of Omicron expected to moderate many of the large

infrastructure projects planned for the UK will finally take off.

As All Steels, we have already seen evidence of steel

buying to cover very large rail-related projects coming to fruition, but you

can also see from construction media reports produced by the likes of Barbour

ABI and Glenigan that the 2022/23 outlook for the construction industry is very

strong. Only this weekend news was released of electric vehicle battery

start-up, Britishvolt securing £1.7 billion of funding to build a new factory

in the North East that even makes an Amazon Warehouse look small all of which

will consume a massive amount of steel to build the new factory.

The forecast for 2022 construction growth is circa 7%

largely created by public sector investment. It is also fair to say that

construction was also constrained during 2021 by the general tight availability

of building materials so many of last year’s construction projects will spill

over into 2022. Much of the supply flow should improve this year allowing

the construction industry to flourish although optimism probably still needs to

be tempered as labour availability is expected to remain tight. Having

said the latter industrial buildings in the construction sector which is one of

the key focus areas for steel consumption is forecast to grow by a staggering

24% during 2022.

Whilst we are confident that steel buying activity will be

strong in the months ahead off the back of the improved sentiment and more

imbalanced stock levels many of the steelmaking cost drivers appear to be

creating a necessity for mills to increase prices further. It would therefore appear that we could be on

course for another re-run of 2021. The only variance this time is that a much

higher steel price base should avoid excessive speculative buying, and this

should logically result in a smoother rising of steel prices rather than the

big leaps we experienced last year.

Hopefully, our opening message above gives a flavour of what

we should expect but here are some of the updated data on steelmaking

ingredients that force mill price changes which reinforce some of the positive

sentiment messages already expressed.

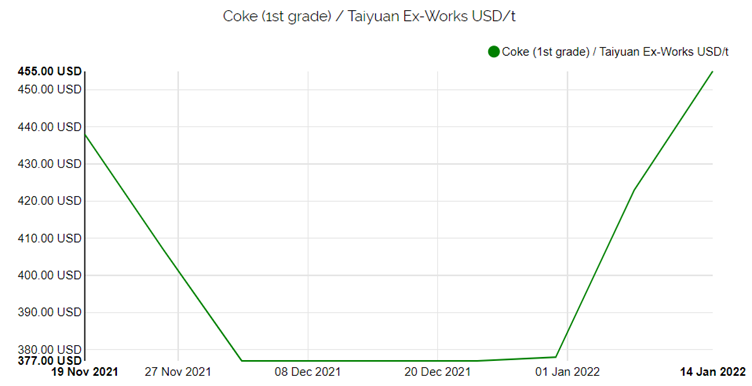

Coking Coal

0.7 tonne used to make a tonne of steel

The recent movement in coking coal prices has remained

under the radar but the new up spin must start to feature in the coming weeks' steel

journals as prices are now at record-breaking levels. It will be renewed

buying activity that has probably been the catalyst for change as Chinese

steelmakers return to the market to build up raw material inventories ready to

increase production immediately after the Beijing Winter Olympics that

concludes on 20 February 2022.

It is also understood that supply disruption currently

exists in some of the major metallurgical coal mines. Trade flows are

also being hampered by rail transfer constraints from mines to the ports.

One such example was caused by an explosion at a coal transfer station in the

US at the Curtis Nay terminal in late December that is one of the main handlers

of this commodity.

The graph below clearly shows the impact for BOS route

steelmakers. Whilst the graph below shows Chinese domestic price movement

the more highly transacted Australian seaborne coking coal hit a historic record

high of $445 per tonne FOB Australia on Friday after a $15 per tonne daily

jump.

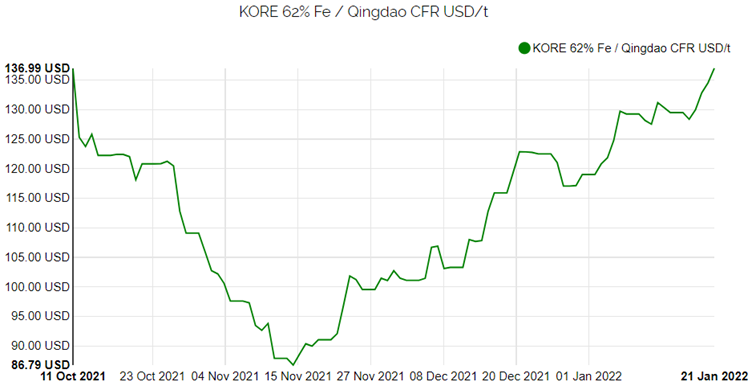

Iron Ore

1.7ttonne used to make a tonne of steel

As conveyed in the coking coal section the increased

Chinese buying activity will also be the probable cause for the recent push up in

iron ore prices and with restocking continuing over the coming weeks, we will

probably see little change to the upward price pressure. This is

surprising news for many pundits that were speculating that iron ore would

remain in the zone of $80-$100 per tonne although it is perhaps the heavy

resumption of steel production planned in China that is likely to have caught

the market by surprise. Such planned growth in steel output obviously questions

China’s commitment to environmental improvements.

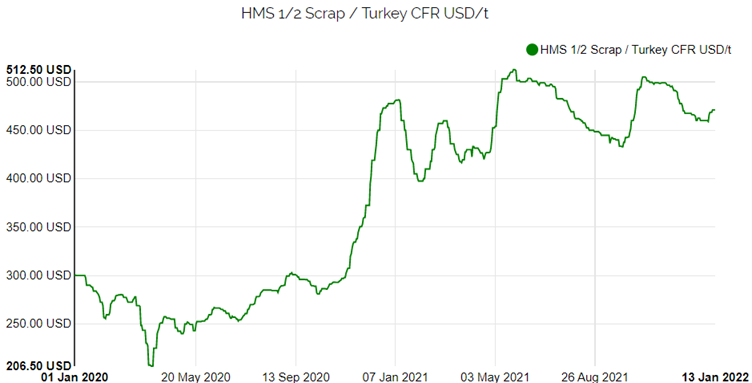

Scrap

tonne used to make a tonne of steel

Scrap rates in Turkey always provide one of the best barometers

for assessing steel prices as the speed of change is always most reactive to

sentiment so it provides excellent direction on future steel prices. The

graph below nicely depicts steel price movement through the pandemic industrial

recovery, but it is the current month's price bounce that should be

spotlighted. The All Steels view is that this immediate curve would have

shown a higher price trend if production output in Turkey had not been

constrained by energy issues which are explained below, nevertheless, this

upward movement must be one of the early signs of another strengthening in

steel prices.

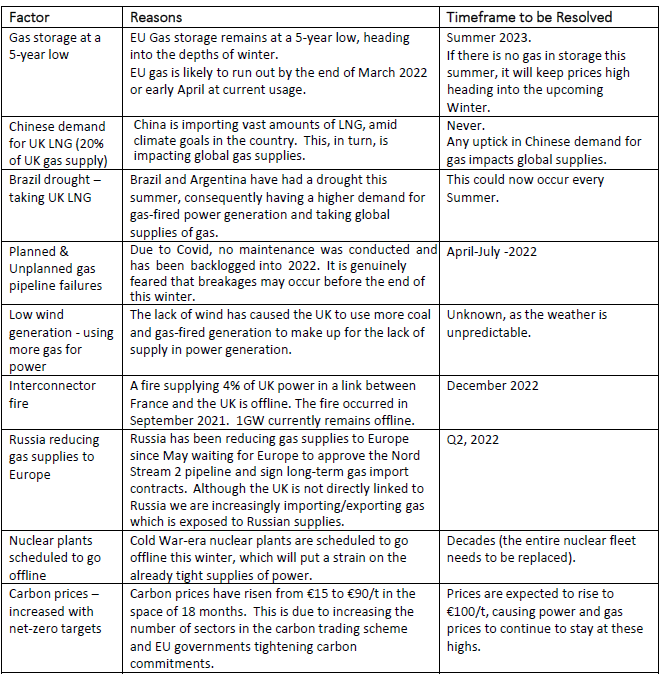

Energy

The cost of gas and electricity remains hot news around the

world and whilst we thought the problem to be just a winter spike issue the

fundamentals would now suggest that high energy costs are likely to remain firm

well into 2023. There are many reports in the public domain produced by energy

brokers and leading utility suppliers to justify the high prices and the table below nicely summarises the factors, reasons and resolution timeframes concerning the UK.

Further afield in Turkey both gas and electric shortages are

so bad that virtually all producers are having to regularly cut output. In the Izmir region for the week ahead, there

are three full days of government-enforced steelmaking closures.

Shipping Prices

The shipping cost of bulk raw materials such as

metallurgical coal /iron ore fell away sharply in Q4, but this was

understandably a reaction to a lack of raw materials flowing into China during

this period as government pressure dictated a cut in steelmaking

capacity. As reported early however Chinese high volume steel production

looks set to come back on stream for the second half of Q1 and just like coking

coal and iron ore prices must be set to rise.

Looking more locally on typical 2,000-3,000t shipload

quantities that service the UK there is no relaxation in shipping prices.

In our last UK steel market evaluation, we reported that we had seen shipping

costs from Turkey increase by $70 per tonne during the period April 2021 to

September 2021. We can now confirm that the shipping costs on our

December inbound material from Turkey increased by another $30 per tonne to

$150 per tonne. What is even more disconcerting is that our main Turkish

hollow section supplier is now indicating that the forward price for Q2 could

be as high as $190 per tonne.

EU suppliers on shorter shipments from Germany, Italy and

Spain are also experiencing a similar surge in costs and on cargo we have just

booked from Italy we have seen a shipping rate increase from September 2021 to

January 2022 of Euro 60 per tonne.

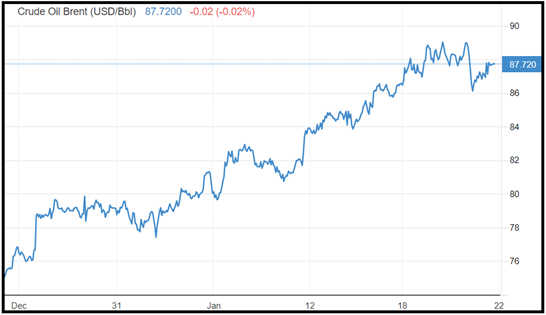

At present we really can’t see any softening in shipping

rates and when you consider that EU steel activity looks set to increase and

marine diesel costs simply follow oil prices that are still trending upwards as

shown in the graph even higher shipping costs look most likely.

Port Congestion

All UK docks remain congested and the peaks and troughs in

trade flows are now creating total mayhem as all importers try to de-risk by advance

bonding material for longer periods at the ports in preparation for the onset

of each new quarter. This is also being compounded by imports increasing

to reflect demand growth and volumes to substitute the loss of domestic supply (left

by large voids due to cuts in capacity to the market by the Liberty Steel Group

particularly on engineering bar supplies).

The overload in the material at the ports is now commonly

resulting in material being block stowed to maximise floor space capacity but

the negatively of this action results in severe delays for material to become

unscrambled for despatch after customs clearance. In some cases, delays

of 4-6 weeks are being experienced. Moreover, due to such huge loadings on

the ports, many have increased storage charges over the last six months from a

low of 25p per tonne per week up to new highs of £2 per tonne per week.

Transport

The good news here is that transport availability

constraints seem to have eased but we must recognise that this is against a

background of lower trade activity in Q4 as the supply chain attempted to

reduce stocks. As we progress through Q1 and into Q2 buying activity and

real underlying demand are all forecast to increase so tight transport problems

are very likely to materialise once again. Even with lower activity, the

cost of transport has remained expensive and with fuel prices yet again rising

we should probably expect more increases in transport costs especially given

that diesel prices continue to move up.

Inflation (Finance)

High inflation levels have already resulted in one recent

bank base rate increase and whilst this movement was small the movement is more

impacting in today’s world of steel with material costs being so high.

More bank rate increases will inevitably be seen in 2022 and whilst this will

add greater cost to the financing of steel inventories it will create wage

pressure, adding even more costs to steel prices in an industry that is still heavily

labour intensive.

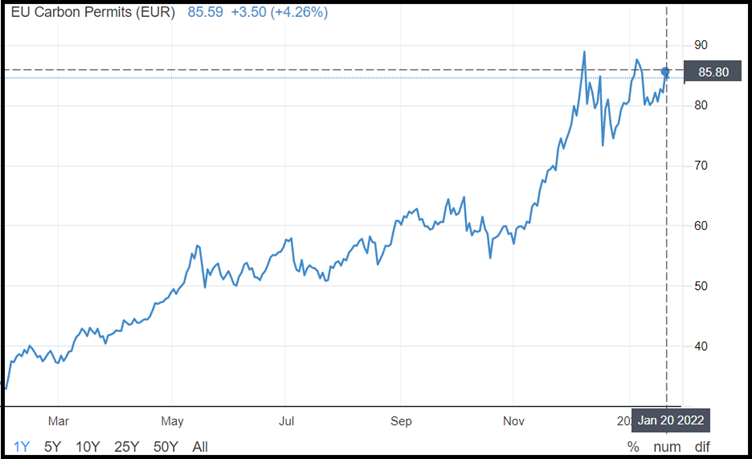

EU Carbon Permits

Since our September report, the cost of Carbon Permits has

advanced by another €21 per tonne to a new record high of €85.80 per

tonne. Such a rise impacts utility costs as referenced above but the

bearing on steel prices through environmental taxes is more direct.

All steel producers are on a path aiming for net-zero

carbon emissions but for many, this will take decades to be realised. In

the short term on capacity exceeding carbon allocations blast furnace operators

must buy 2t of CO2 for each tonne of steel produced whereas electric

arc manufacturers depending on the efficiency of their plant must buy 0.5-0.8t

of CO2 for each tonne of steel manufactured. As can be seen from the graph below these

costs were insignificant 12 months ago but the impact today is very significant

and with the cost of carbon permits continuing to rise this will just become an

even bigger cost for those plants that fail to reduce carbon emissions.

In blast furnace production the carbon tariff escalation

cost adds €171.60 per tonne to steel manufacturing costs (£143.60p per

tonne). In EAF manufacture the cost is somewhere between €42.90p -

€68.64p per tonne.

UK Safeguard Duties

Safeguard duties seem to be

impacting more of our inbound supplies and the cost of such duties are now

becoming more punishing as it is a percentage charge on what are

ever-increasing steel prices. We are also finding that HMRC’s

administration of quota monitoring and reporting is becoming so bad that

traders are losing visibility as to when quotas become exhausted and by what level

thresholds have been exceeded.

New rules on category 12

(effectively merchant bar/engineering bar) have tried to split out these

products into two separate categories through chemical composition rules but

material intended as general structural steel supply is regularly falling into

the engineering bar classification due to high residuals such as copper. Consequently, customs clearance is in total

disarray.

On truckloads, this confusion has

caused serious delays on customs clearances all of which adds to transport

demurrage costs. The big issue here however is that as a mass importer of

steel, as of today (23-1-22), we have no idea of our duty liability on material

customs cleared on 1 January 22 and little clarity on what quota, if

any, remains available in products that we are landing in the UK during the

coming week.

Conclusion

There are many other factors that

we could report upon all of which are upwardly affecting steel prices but, in

this report, we have simply tried to focus on just the main steel price

influencers. We could for example expand

on energy and steel price inflation caused by the threat of war between

Russia/Ukraine that would have an unbelievable impact, but this would be

speculative whereas we are just choosing to report on actual known facts.

As a steel trader that takes

large stock positions the fear of a price crash is our biggest risk/concern and

the reason why we must analyse steel price influencers in such detail. It is against this background that we have

resumed buying heavily for our Q2 requirement despite the high prevailing steel

prices. We recommend that you take a pragmatic

view on the data presented here, and make sure that you are reflecting

anticipated replacement prices on the extremely valuable stock you hold for

sale.